Offshore Investing Guide

We understand that preserving and growing your wealth on a global scale presents both unique opportunities and complexities.

Invest Offshore Blog Posts

-

Israel-Hamas War Spooks Markets as Investors Urged to Avoid Knee-jerk

Oil prices surged by 5% following Hamas’ unexpected attack on Israel over the weekend, but investors need to avoid knee-jerk reactions, warns the CEO of one of the world’s largest independent financial advisory, asset management and fintech organizations. The warning from Nigel Green of deVere Group comes as global investors digest the news that the…

-

Ambev’s Decline and Costco’s Gold Rush: Harbingers of Economic Concern?

In a world defined by its rapid pace of change, economic signal come in many forms. For businesses and economists alike, these signals provide a harbingers hint, a glimpse into potential forthcoming events in the economy. Two such recent signals have sparked debates: Ambev’s reported 15.2% decline in second-quarter net profit and Costco’s sell-out of…

-

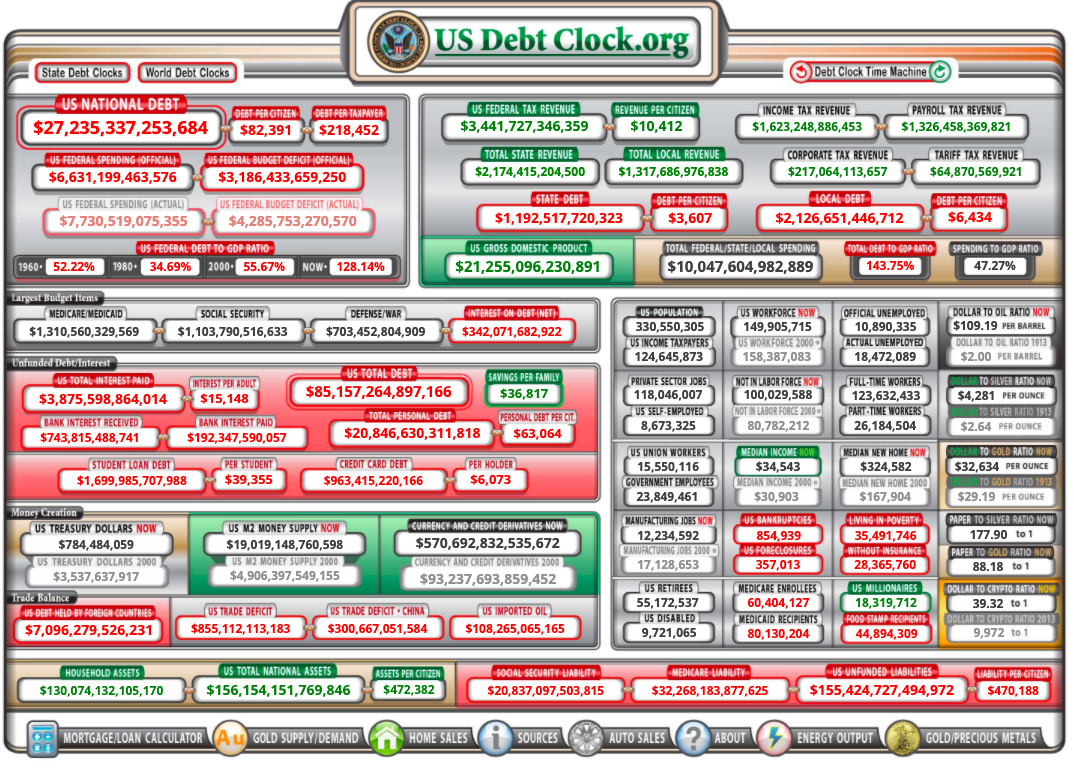

U.S. National Debt Reaches $33 Trillion

Understanding the Implications of a Maxed Out Debt Clock The U.S. National Debt has reached an alarming milestone: $33 trillion. This astronomical figure, unparalleled in U.S. history, comes at a time when concerns about the nation’s fiscal health are more pronounced than ever. Alongside this, the U.S. Debt Clock, a symbolic representation of the country’s…

-

Offshore Tax Havens: Luxembourg, Liechtenstein, and Andorra – A Comparative Analysis

In the realm of international finance, offshore tax havens have garnered significant attention. These jurisdictions provide businesses and individuals with favorable tax regimes, enhanced privacy measures, and often, a combination of other benefits. Three of the most well-recognized tax havens are Luxembourg, Liechtenstein, and Andorra. This article aims to compare the distinct features of these…

-

Embracing the Quantum Financial System: Risks and Rewards

The evolving global financial landscape is seeing many groundbreaking shifts, with the Quantum Financial System (QFS) heralded as the future of banking and finance. Touted as the most significant financial evolution since the advent of centralized banking systems, the QFS promises a more secure, transparent, and instantaneous way of conducting transactions. As with any transformative…

-

Time to End the Fed and Its Mismanagement of Our Economy

Every major economic downturn of the last 110 years bears the mark of the Federal Reserve. In fact, as long as the Fed has been around, it has swung the economy between inflation and recession. Yet Americans, surprisingly, have tolerated it. But we shouldn’t expect that to go on forever. We had three central banks before the Fed, and confined…

-

Top Five Countries to Set Up an Offshore Company

In an increasingly globalized world, many businesses are looking to expand their operations beyond their home countries. For various reasons — ranging from tax benefits to asset protection — entrepreneurs and corporations consider setting up offshore companies. But where are the best places to do this? Here’s a look at the top five countries for…

-

Expatriates in Vancouver: Population Estimates and Trends

Vancouver, a city renowned for its breathtaking natural beauty, cultural diversity, and quality of life, has long been an attractive destination for immigrants and expatriates from around the globe. As of my last update in January 2022, Vancouver, and its metropolitan area, has seen significant growth in its expatriate population. This article delves into the…

-

Canadian Snowbird Real Estate Speculation: A Guide to Sunnier Investments

The term “snowbird” is familiar to many Canadians: those individuals who migrate south during the winter to escape the biting cold and enjoy warmer climes. But beyond seeking just sun and surf, a growing number of snowbirds are seeing golden opportunities in real estate speculation. For those considering a jump into this venture, here’s an…

Join 900+ subscribers

Stay in the loop with everything you need to know.