Offshore Investing Guide

We understand that preserving and growing your wealth on a global scale presents both unique opportunities and complexities.

Invest Offshore Blog Posts

-

From the Tax Law Offices of David W. Klasing – The Difference Between Tax Avoidance vs. Tax Evasion

IRVINE, Calif., Feb. 7, 2025 /PRNewswire/ — Federal tax law attempts to delineate a very clear distinction between tax avoidance, which can at worst only expose the Tax Practitioner and his or her client to potential civil tax penalties, and tax evasion, for which criminal tax penalties may apply to all parties concerned. The Supreme Court in Gregory…

-

The Top 10 Richest Countries in the World by GDP Per Capita

Gross Domestic Product (GDP) per capita is a key indicator used to gauge a country’s economic performance and the average wealth of its citizens. By examining GDP per capita, we can identify the nations where prosperity is most prevalent. As of 2025, based on data from the International Monetary Fund (IMF) and other reputable sources,…

-

The End of the Chevron Doctrine: A Turning Point for U.S. Regulatory Power and the Implications for Secrecy Orders

On June 28, 2024, the Supreme Court of the United States (SCOTUS) delivered a landmark decision by overruling the Chevron doctrine, a cornerstone of U.S. administrative law for four decades. This decision significantly curtails the power of federal agencies to interpret ambiguous statutes and shifts authority back to the judiciary. The ramifications of this ruling…

-

Strategic Bitcoin Reserve: A Game Changer for U.S. Crypto Policy?

The concept of a strategic Bitcoin reserve is gaining momentum, with influential figures like Robert Bessent, the newly appointed Treasury Secretary and Howard Lutnick the Commerce Secretary, both expressing interest in establishing a wealth fund to invest in cryptocurrency. Both financial heavyweights “like Bitcoin” and could spearhead an initiative that not only secures a national…

-

Trump Establishes U.S. Sovereign Wealth Fund to Monetize National Assets

On February 3, 2025, President Donald Trump signed an executive order establishing the first-ever U.S. Sovereign Wealth Fund, a strategic move aimed at monetizing the nation’s assets to generate value for American citizens. This initiative, led by Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick, seeks to transform underutilized federal assets into profitable investments…

-

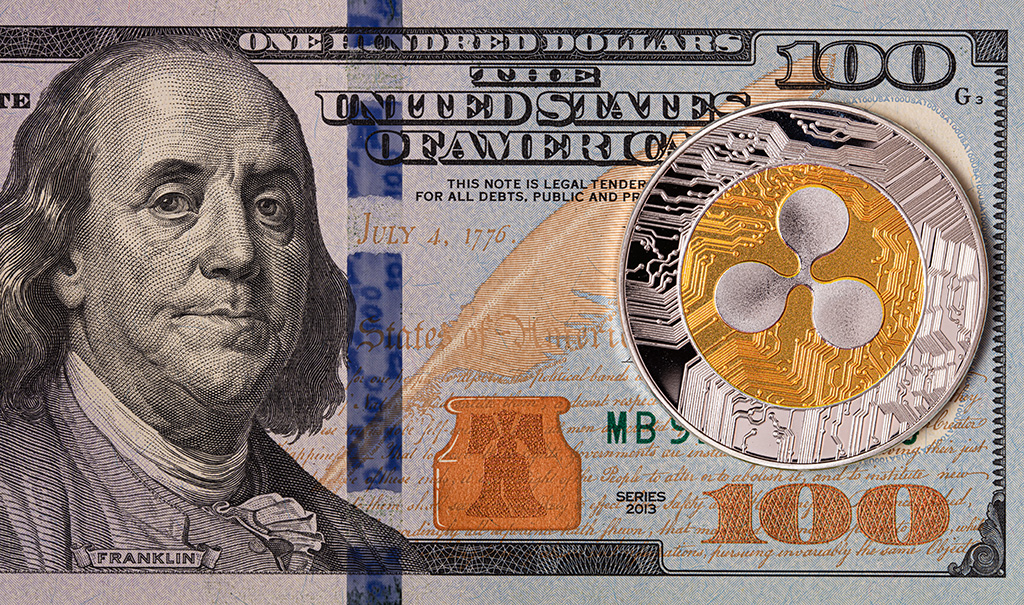

XRP and the U.S. Economy: A Bold Prediction for the Future

In a world teetering on the edge of financial transformation, XRP stands at the forefront of what could be the most significant shift in global finance since the inception of Bitcoin. The U.S. economy, struggling with debt, inflation, and shifting monetary policies, may soon witness the rise of XRP as a pivotal player in international…

-

U.S. Department of the Treasury Withdraws from the Network of Central Banks and Supervisors for Greening the Financial System (NGFS)

WASHINGTON – The U.S. Department of the Treasury’s (Treasury) Federal Insurance Office (FIO) today notified the Network of Central Banks and Supervisors for Greening the Financial System (NGFS) that it is withdrawing its membership. Withdrawal from NGFS is one part of implementing President Trump’s Executive Orders Putting America First in International Environmental Agreements and Unleashing…

Join 900+ subscribers

We adhere to the highest privacy standards, ensuring that your personal information is treated with the utmost respect and confidentiality.