Offshore Investing Guide

We understand that preserving and growing your wealth on a global scale presents both unique opportunities and complexities.

Invest Offshore Blog Posts

-

The Truth About Money: Your Dollars Are Mostly Database Entries

When most people picture “money,” they see paper bills changing hands. That picture is comforting. It’s also wildly out of date. In the United States, cash is a minority of what we call money. By the end of 2024, total currency in circulation was about $2.323 trillion. (FRED) Meanwhile, a broad money measure like M2…

-

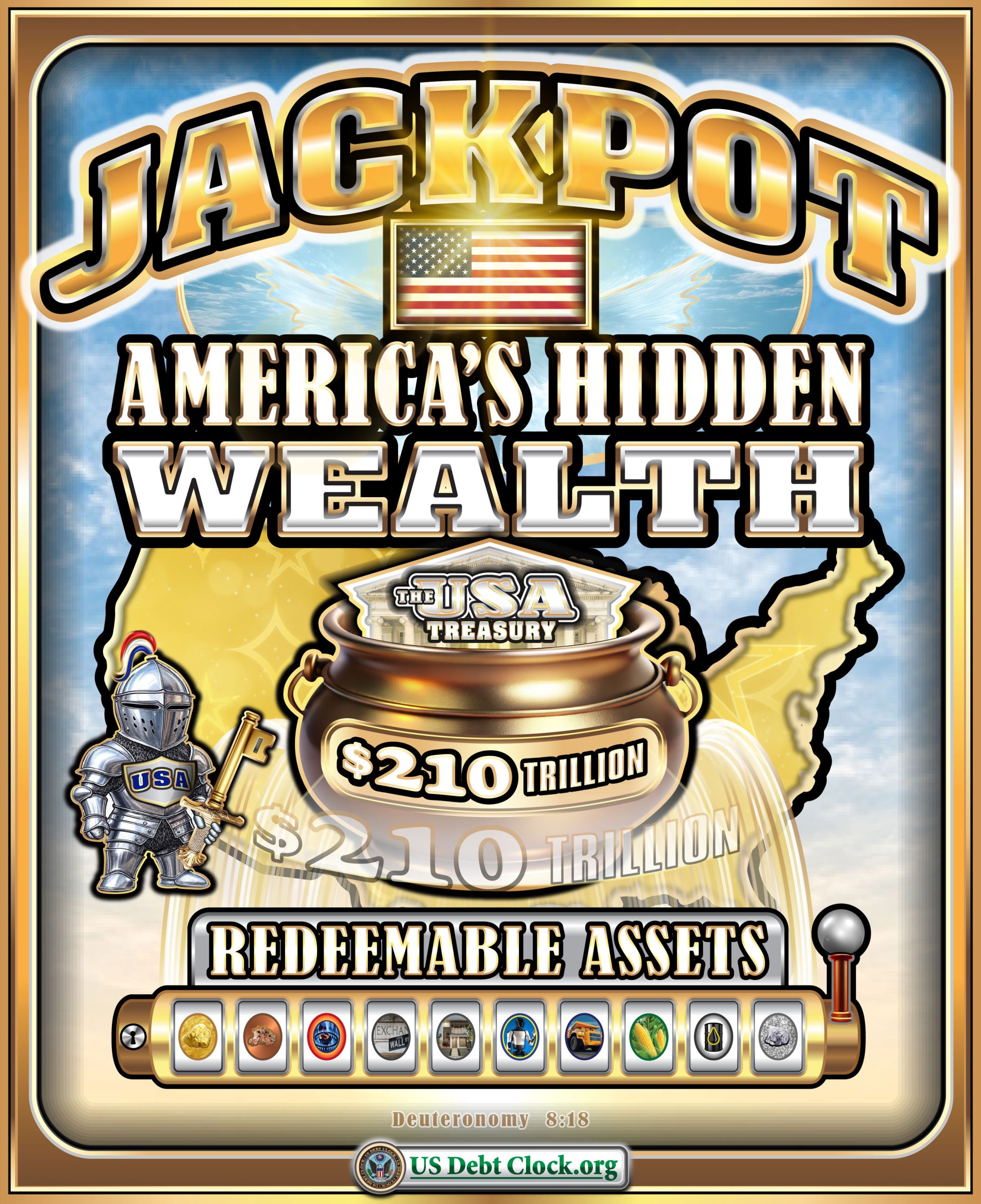

Jackpot! America’s Hidden Wealth of $210 Trillion in Redeemable Assets

A striking graphic branded US Debt Clock has been circulating from February 5, featuring a slot-machine theme and the headline “JACKPOT — AMERICA’S HIDDEN WEALTH” with a central pot labeled “The USA Treasury” and a bold figure: $210 TRILLION. Along the bottom, the words “REDEEMABLE ASSETS” sit above a row of commodity-style icons (think hard…

-

Wall Street has Captured Bitcoin and Turned into a Derivative

By Gordon Gekko, for Invest Offshore You still think Bitcoin trades like a clean, supply-and-demand asset? Then listen closely—because that market no longer exists. What you’re watching isn’t “weak hands.” It isn’t sentiment. It isn’t retail panic-selling. It’s a structural takeover—the kind that happens when Wall Street gets its claws into something scarce, something pure……

-

Memo to XRP Hodl’ers: Long Way to Go to the Top

Among crypto investors, few numbers generate more excitement — and more confusion — than market cap and dominance. When XRP is quoted at “$74.1B market cap, 3.20% dominance,” it sounds massive. And in some ways, it is. But for long-term XRP holders, these numbers tell a more nuanced story: 👉 XRP is already large.👉 XRP…

-

Best Global Oceanfront Investment Locations in 2026

When it comes to real estate that blends lifestyle appeal with strong financial returns, oceanfront property consistently ranks among the most desirable asset classes worldwide. In today’s market, investors are looking for coastal destinations that offer a rare combination of high tourism demand, stable legal frameworks, robust rental yields, and long-term capital appreciation. Based on…

-

Bitcoin Betrayal: A Potential Financial Scam of Epic Proportions?

Disclaimer: The following article examines claims circulating online and explores hypothetical risk scenarios. These allegations are unproven and highly contested. Invest Offshore does not endorse these claims as fact. However, because of their potential implications for market confidence, they warrant very careful analysis. Allegations of Hidden Control Over Bitcoin and What It Could Mean for…

-

Brink’s: The Hidden Financial Institution Powering the World’s Banks and SKR Cash Pallet Transactions

When investors think about “financial institutions,” they usually picture banks, credit unions, and brokerages.But behind nearly every major bank sits a different kind of giant — one that rarely makes headlines, yet quietly powers the physical money system. That giant is Brink’s. Brink’s is not an offshore bank. It does not take deposits or make…

-

The Return of the People’s Money and End of the Banking Age

The tide has turned. The Age of the Bankers is closing its last ledger, and the Age of the Treasury—the people’s money—is roaring in like a storm with Donald J. Trump at the helm. On January 30, 2026, Trump made the kind of move that sends shivers down K Street’s spine and rattles the foundations…

Join 900+ subscribers

We adhere to the highest privacy standards, ensuring that your personal information is treated with the utmost respect and confidentiality.