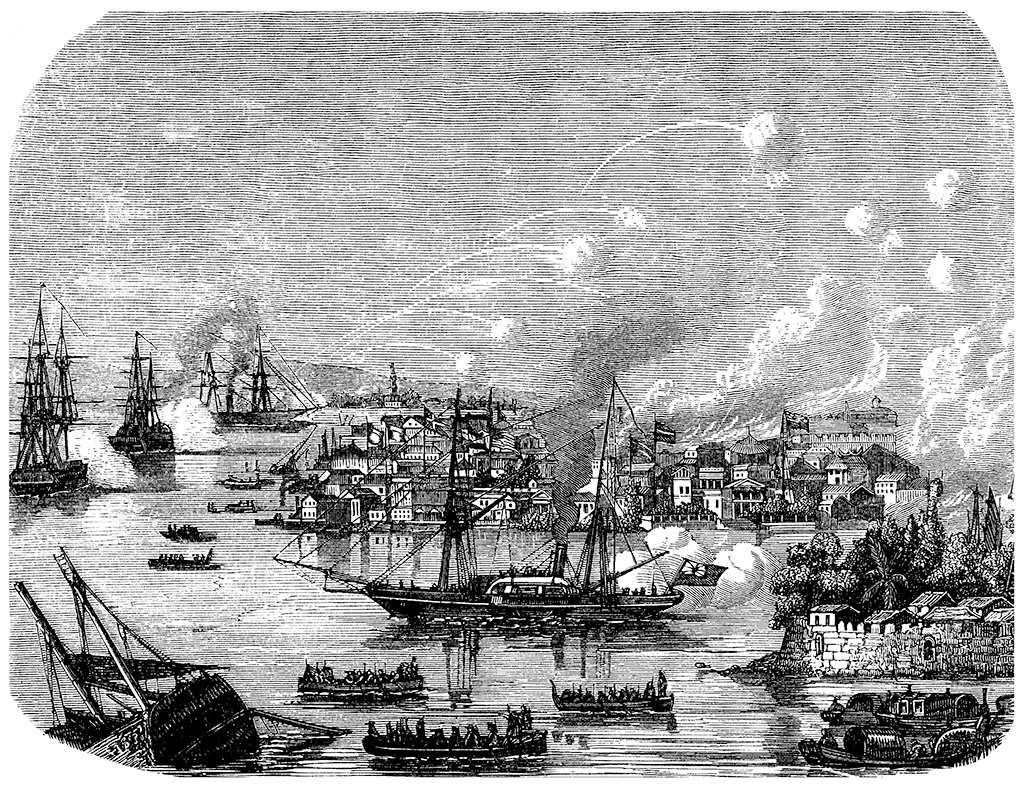

In the old days, the British sent their boats full of opium to China. They wanted tea and silk and silver. China wanted none of the poison. The emperor issued edicts. Burn the opium. Close the ports. No more foreign devils ashore.

It was a straight-up collision between trade and sovereignty. The British gunboats answered back. The Opium Wars began.

The year was 1842 when the Treaty of Nanking was signed. The British forced China to open its belly and hand over Hong Kong. That rocky island, windswept and wild, became the first true hub of offshore banking. Not because the Brits were visionaries. Not because they dreamed of finance. But because they needed a beachhead. A place where ships could dock, deals could be made, and money could move without the weight of Chinese law.

Hong Kong was the loophole. The gateway to East Asia. A smuggler’s dream. A financier’s paradise.

Banks sprouted. The Hongkong and Shanghai Banking Corporation (HSBC) was born to grease the wheels of empire. It started simple: warehousing silver, settling tea debts, and trading opium profits. Then it grew. Trade begat finance, finance begat offshore, and offshore begat the global flows of money we know today.

What started as a wartime workaround became the foundation of modern offshore banking.

Fast forward 180 years.

Now it’s China’s turn. This time, the ships aren’t carrying opium. They’re loaded with fentanyl precursors and cheap consumer junk. The poison flows not east but west, flooding American veins, wrecking families, and gutting communities. The same story, new cast.

Washington is angry. The president’s men slap tariffs on Chinese goods. They tighten controls. Ships are held offshore. Containers sit idle. The message: no more poison. No more free ride. The ports of entry—Long Beach, Savannah, Newark—are bottlenecked by politics and purpose.

The irony is thick enough to cut with a dull knife.

The same way China tried to keep British opium out, America is now trying to stop Chinese fentanyl from coming ashore. The same way the British used Hong Kong as a wedge to force trade, the Chinese have spent the last 30 years using offshore structures—Hong Kong included—to tie their economy to the West. And now, just like that, the cycle turns.

The tariffs hit hard. Not just the junk and poison, but the legitimate goods too. Chinese factories sit quiet. Workers are laid off. Supply chains unravel. Ships turn around, half-empty, looking for new markets. The global trade machine hiccups and stalls.

And what of Hong Kong?

Once the crown jewel of empire, Hong Kong now sits in a strange purgatory. The British are long gone. The Chinese flag flies overhead. But the city still plays its old game: offshore finance, a touch of smuggling, and a lot of shadow play. Capital flows in and out, dodging Beijing’s iron grip and Washington’s sanctions.

But it’s not what it was. The world is changing fast.

America is building walls—not just at its borders but around its markets. The dollar still reigns, but rivals are gathering. Offshore banking itself, born of those old imperial maneuvers, is under scrutiny. FATCA, CRS, OECD blacklists. The regulators are circling like sharks.

Still, the hunger remains. Money likes to move. It likes secrecy. It likes safe harbors.

And history, well, history has a sense of humor.

China’s Belt and Road Initiative, for all its glossy brochures, is just a new riff on the old imperial song. Ports, railroads, debt traps. The same levers, different uniforms. Africa, Latin America, Southeast Asia—they’ve seen this movie before.

And America? It’s learning the old British lesson: when you let your enemy flood your streets with dope, you pay in silver and blood.

So here we are. Two centuries on. The same trade battles, the same dirty tricks. Ships offshore, banks in the shadows, and governments scrambling to catch up.

The offshore world was born from conflict and smuggling. It matured into a sophisticated web of finance. Now, under pressure from tariffs and tech wars, it’s mutating again.

There’s a new Hong Kong waiting somewhere. Maybe it’s Singapore, maybe Dubai, maybe a blockchain address floating in cyberspace. But the need—the raw, relentless need—for offshore solutions will never die.

Trade wars are messy. But they always leave a trail of loopholes and opportunities.

And as long as governments make rules, the rich and the desperate will look for ways around them. That’s the real offshore legacy of the Opium Wars.

It’s not over. It never is.

📜 Timeline: From Opium Wars to Fentanyl Trade Tensions

19th Century: The Opium Wars and the Birth of Hong Kong as an Offshore Hub

- 1839: China’s Qing dynasty, under Commissioner Lin Zexu, enforces a ban on opium imports, leading to the seizure and destruction of British opium stocks in Canton.(Wikipedia)

- 1840: In response, Britain launches the First Opium War to protect its trade interests.(Basic Law Online)

- 1842: The Treaty of Nanjing is signed, ending the war. China cedes Hong Kong Island to Britain, opening it as a strategic port and laying the foundation for its future role in offshore finance.(Encyclopedia Britannica)

- 1843: The Treaty of the Bogue grants Britain “most-favored-nation” status and extraterritorial rights in China, further expanding foreign trade privileges.(Wikipedia)

21st Century: Fentanyl Crisis and U.S.-China Trade Disputes

- 2010s: Fentanyl, a potent synthetic opioid, becomes a leading cause of overdose deaths in the U.S., with many precursors traced back to Chinese manufacturers.(The Guardian)

- 2018: The U.S. initiates a trade war with China, imposing tariffs on various goods, citing unfair trade practices and intellectual property theft.

- 2023: The U.S. reports nearly 75,000 fentanyl-related deaths, intensifying scrutiny on China’s role in supplying precursor chemicals.(Reuters)

- 2025:

🔁 Parallels Between the Two Eras

- Substance Control: Both periods involve conflicts over the trade of harmful substances—opium in the 19th century and fentanyl in the 21st century.

- Trade Conflicts: Economic disputes escalate into broader conflicts, with military action in the Opium Wars and tariff wars in the modern era.

- Offshore Financial Centers: Hong Kong emerges as a pivotal offshore hub post-Opium Wars; in contemporary times, concerns arise over Chinese e-commerce platforms exploiting trade loopholes.

Leave a Reply