Bitcoin is unique in the financial universe because it is a finite digital asset. Unlike fiat currencies that can be printed endlessly, Bitcoin has a hard-coded maximum supply of 21 million coins. As of mid-2025, approximately 19.7 million BTC have been mined, leaving fewer than 1.3 million BTC remaining to be unlocked.

How Many Miners Are Working Today?

Globally, hundreds of thousands of mining rigs are active at any given moment, operated by:

- Major mining pools such as Foundry USA, AntPool, and F2Pool, which aggregate the hashing power of individual miners to increase block rewards consistency.

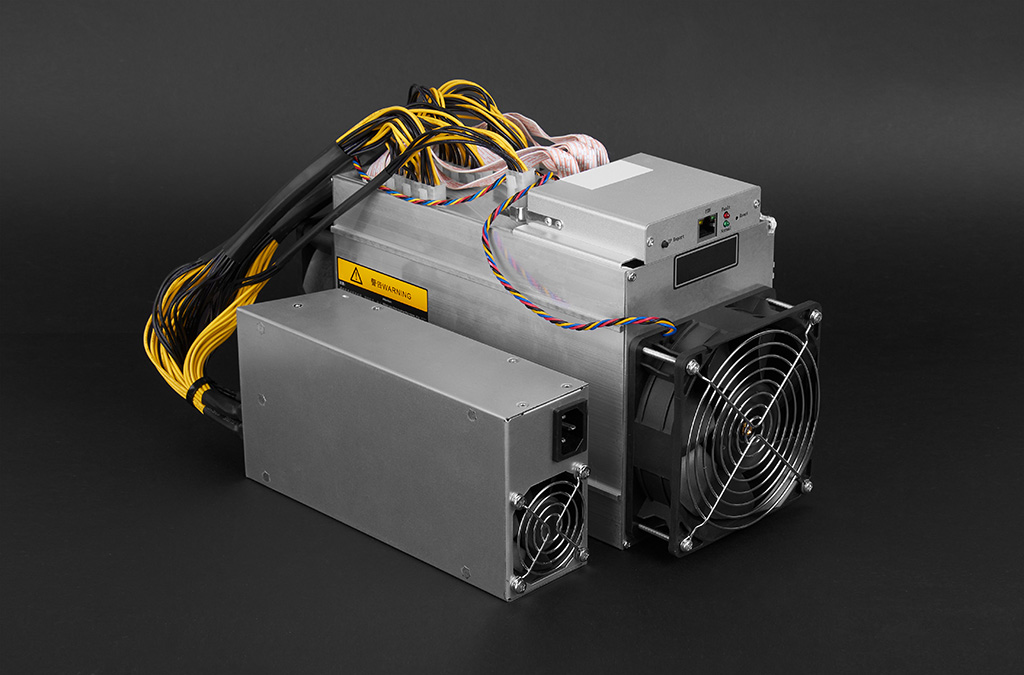

- Industrial-scale farms in Texas, Iceland, Kazakhstan, Russia, and Paraguay, housing tens of thousands of ASIC (Application-Specific Integrated Circuit) machines each.

- Small individual miners operating a few rigs from home or in community mining co-ops, though their market share is tiny compared to industrial players.

The global Bitcoin hash rate (computational power dedicated to mining) hovers around 600–800 exahashes per second (EH/s) in 2025, representing an astronomical scale of global effort and energy consumption to secure the network and verify transactions.

Mining Down to the Last Satoshi

Bitcoin is divisible down to one hundred millionth of a BTC, called a satoshi. The block reward halves approximately every four years (every 210,000 blocks). Currently, in 2025, the reward is 3.125 BTC per block after the last halving in April 2024.

At this pace, block rewards will continue to halve until they effectively reach zero around the year 2140. By then:

- All 21 million BTC will be mined.

- Miners will no longer receive block rewards, only transaction fees as their income source.

What Happens When All Bitcoin is Mined?

When the final satoshi is mined:

- Transaction Fees Sustain the Network

- Miners will rely solely on fees users pay to send transactions.

- These fees are expected to rise to incentivize miners to continue validating transactions and securing the blockchain.

- Network Security Remains Critical

- High transaction volume and fee incentives will keep mining profitable.

- If fees are insufficient, hash power may decline, potentially affecting security, but Bitcoin’s adaptive difficulty adjustments aim to balance this risk.

- Bitcoin Becomes Purely Deflationary

- With no new supply issuance, Bitcoin’s scarcity becomes absolute.

- Lost BTC (due to lost wallets and keys) effectively reduce circulating supply, increasing scarcity further.

- Store-of-Value Status Strengthens

- Bitcoin’s narrative as ‘digital gold’ will solidify.

- Its fixed supply makes it immune to inflationary debasement, unlike fiat currencies or even mined commodities like gold.

- Potential for Layer 2 Solutions

- As on-chain fees rise, more transactions may move to Lightning Network or similar second-layer solutions, increasing efficiency while miners focus on settlement layers.

As of today (July 2, 2025), approximately 450 BTC are mined every day.

Here’s how that breaks down:

- The current block reward is 3.125 BTC (post-April 2024 halving).

- On average, one new block is mined about every 10 minutes.

- That equates to roughly 144 blocks per day, so: 3.125×144=450 BTC/day 3.125 \times 144 = 450

📊 Why This Matters

- This daily issuance rate will remain steady at ~450 BTC/day until the next halving event, expected in April 2028.

- It contributes to the new supply inflation, currently around 1.6% annually.

- Once the next halving drops the reward to 1.5625 BTC, daily issuance will fall to roughly 225 BTC/day.

A Unique Monetary Experiment

The mining of Bitcoin down to the last satoshi represents a historic shift in how humans understand money, supply, and economic incentives. Never before has an asset been programmed with an unchangeable issuance schedule and finite ceiling, immune to political or institutional manipulation.

As Bitcoin approaches its final reward era, the questions of sustainability, miner incentives, and transaction economics will shape its role in global finance for decades to come.

Invest Offshore continues to monitor these developments to help our readers understand and position themselves strategically in the era of digital scarcity. If you seek exposure to Bitcoin mining, OTC big block acquisitions, or tokenized digital asset funds, contact us to discuss structured entry pathways.

Leave a Reply