Category: Economics

-

The New Money Revolution: What If BRICS Nations Offloaded U.S. Debt?

In the evolving financial landscape, one question looms large: What would happen if the BRICS nations—Brazil, Russia, India, China, and South Africa—decided to collectively offload their holdings of U.S. debt? With de-dollarization and economic independence from Western financial systems becoming core strategies for these nations, this hypothetical scenario could have significant repercussions for the U.S.…

-

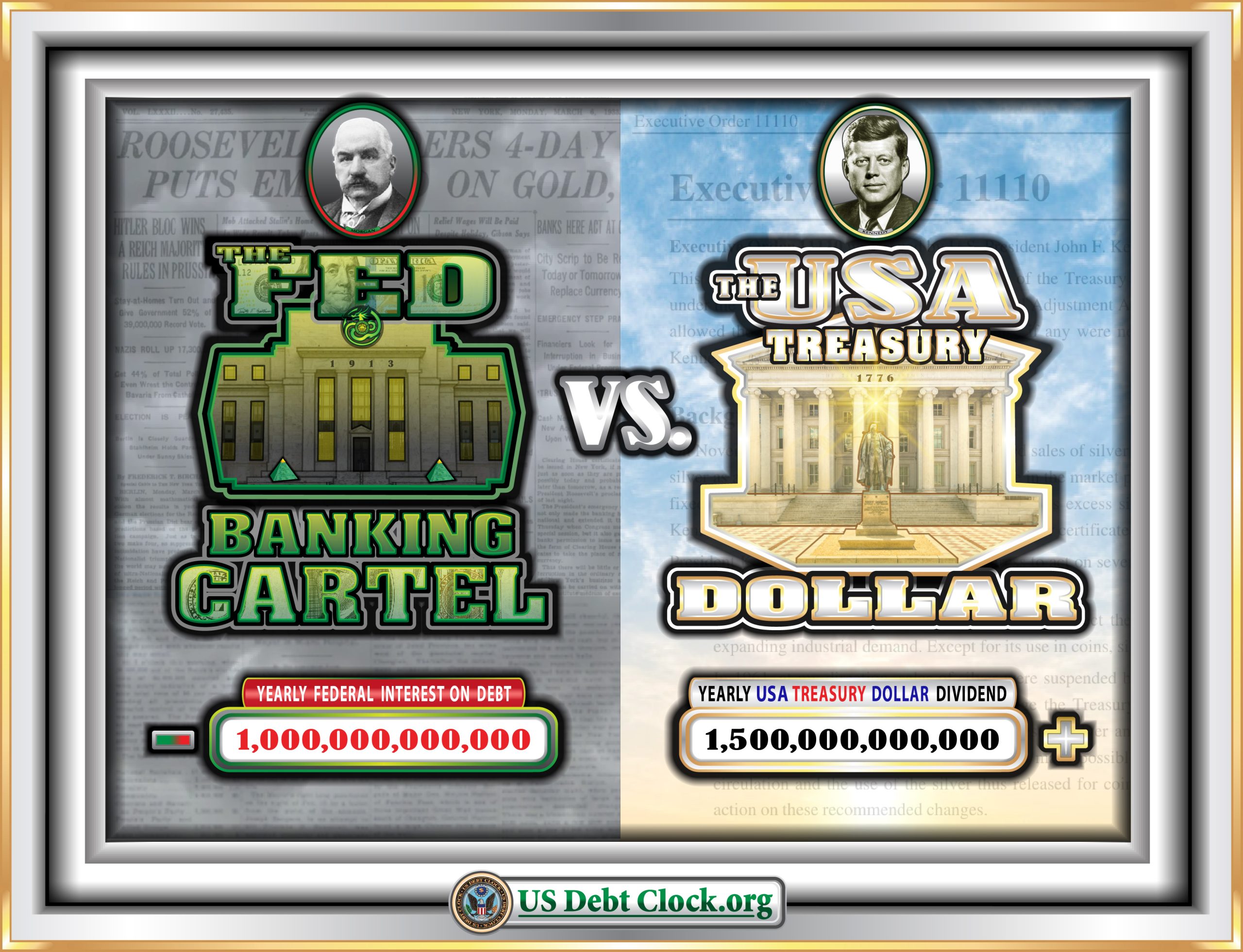

The New Money Revolution: Treasury Certificates, Dividend Dollars, and Bypassing the Federal Reserve

In our previous discussion about the transition from Federal Reserve Notes (FERN) to Treasury Certificates, we highlighted the quiet monetary transformation taking place in the United States, illustrated by the images from @USDebtClock_org. Now, let’s dig deeper into how these changes could reshape the financial system, bypass the Federal Reserve, and introduce a new economic…

-

Silver’s Resurgence: Revisiting the “Crime of 1873” and the Return of an 8-to-1 Ratio

Silver, long overshadowed by gold, is breaking out from the confines of its status as the “poor man’s gold.” Its recent rally has reinvigorated interest in this once-vital metal, spurring a renewed focus on its potential. Investors, both large and small, are taking note, and with good reason: silver’s value is experiencing a significant shift…

-

Bullion Rallies Amid Global Shifts: Fed Rate Cut and IMF Growth Projections Boost Gold’s Appeal

In a year marked by geopolitical tensions and economic uncertainty, bullion has emerged as a standout performer, climbing over 31% and shattering multiple record peaks. Investors seeking a reliable hedge against global turbulence have flocked to precious metals, driving prices higher and demonstrating bullion’s enduring role as a safe-haven asset. The rally was further ignited…

-

IRS Unveils New Federal Income Tax Brackets For 2025

by Tyler Durden The IRS on Oct. 22 unveiled the new federal income tax brackets for 2025. As The Epoch Times’ Zachary Stieber reports, each bracket was changed, including the top one. Single taxpayers making more than $636,350, or couples making more than $751,600, will be subject to a 37 percent tax rate. That’s up from $609,350, and $731,200, respectively.…

-

The Fiscal Tightrope: U.S. Interest Payments Outpace Defense Spending

The latest figures from the U.S. Treasury for fiscal 2024 have sparked serious discussions about the sustainability of the country’s financial health. Jim Rickards, a prominent financial commentator, encapsulated the issue perfectly: “Interest on debt: $882 billion. National defense: $874 billion. That’s all, folks. You can’t borrow your way out of a debt crisis. You…

-

Ripple Announces Ripple USD Exchange Partners for Global Distribution

Former FDIC Chair Sheila Bair, Vice Chairman of Partners Capital and former CENTRE Consortium CEO David Puth, and Ripple Executive Chairman Chris Larsen Join the RLUSD Advisory Board Ripple, the leading provider of digital asset infrastructure for financial institutions, announced its exchange partners and customers for Ripple USD (RLUSD), an enterprise-grade, USD-denominated stablecoin created with…

-

The New Money Revolution: U.S. Debt Clock and the Shift from FERN to Treasury Certificates

In recent months, a significant shift has been quietly taking place in the financial world, and it’s being illustrated in real-time on social media platform X, via @USDebtClock_org. For those closely monitoring the images and data displayed, it’s clear that these are not merely visual representations of government debt but signs of an impending monetary…

-

A Black Swan in Japan’s Financial Waters

Japan has held the line, keeping interest rates near zero. It’s a choice they’ve made for decades, but now the world’s tides are shifting. A sudden change in global interest rates could push Japan into unfamiliar, dangerous waters. And when the storm hits, it won’t just be local. The low rates have helped Japanese banks…