Category: Economics

-

The Great Transition from the Debt-based Dollar to the Asset-backed Dollar

The February 20 graphic from the US Debt Clock is the most obvious depiction yet of what many readers call the New Money Revolution: a stylized “before and after” showing a DEBT-BASED DOLLAR transforming into a U.S. Department of the Treasury 100% RESERVE, ASSET-BACKED DOLLAR. It’s designed like a poster you can’t ignore—big headline (“THE…

-

The Truth About Money: Your Dollars Are Mostly Database Entries

When most people picture “money,” they see paper bills changing hands. That picture is comforting. It’s also wildly out of date. In the United States, cash is a minority of what we call money. By the end of 2024, total currency in circulation was about $2.323 trillion. (FRED) Meanwhile, a broad money measure like M2…

-

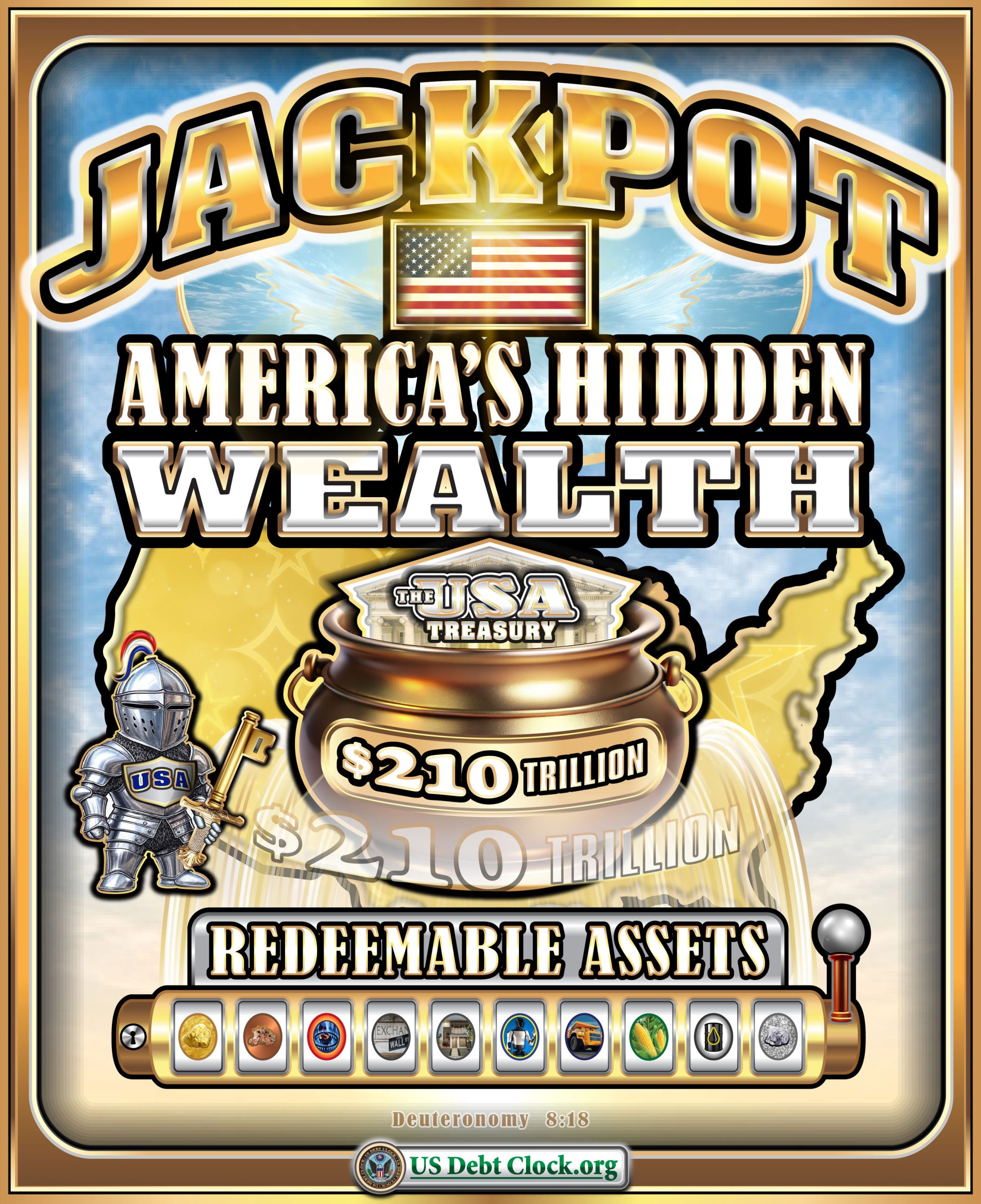

Jackpot! America’s Hidden Wealth of $210 Trillion in Redeemable Assets

A striking graphic branded US Debt Clock has been circulating from February 5, featuring a slot-machine theme and the headline “JACKPOT — AMERICA’S HIDDEN WEALTH” with a central pot labeled “The USA Treasury” and a bold figure: $210 TRILLION. Along the bottom, the words “REDEEMABLE ASSETS” sit above a row of commodity-style icons (think hard…

-

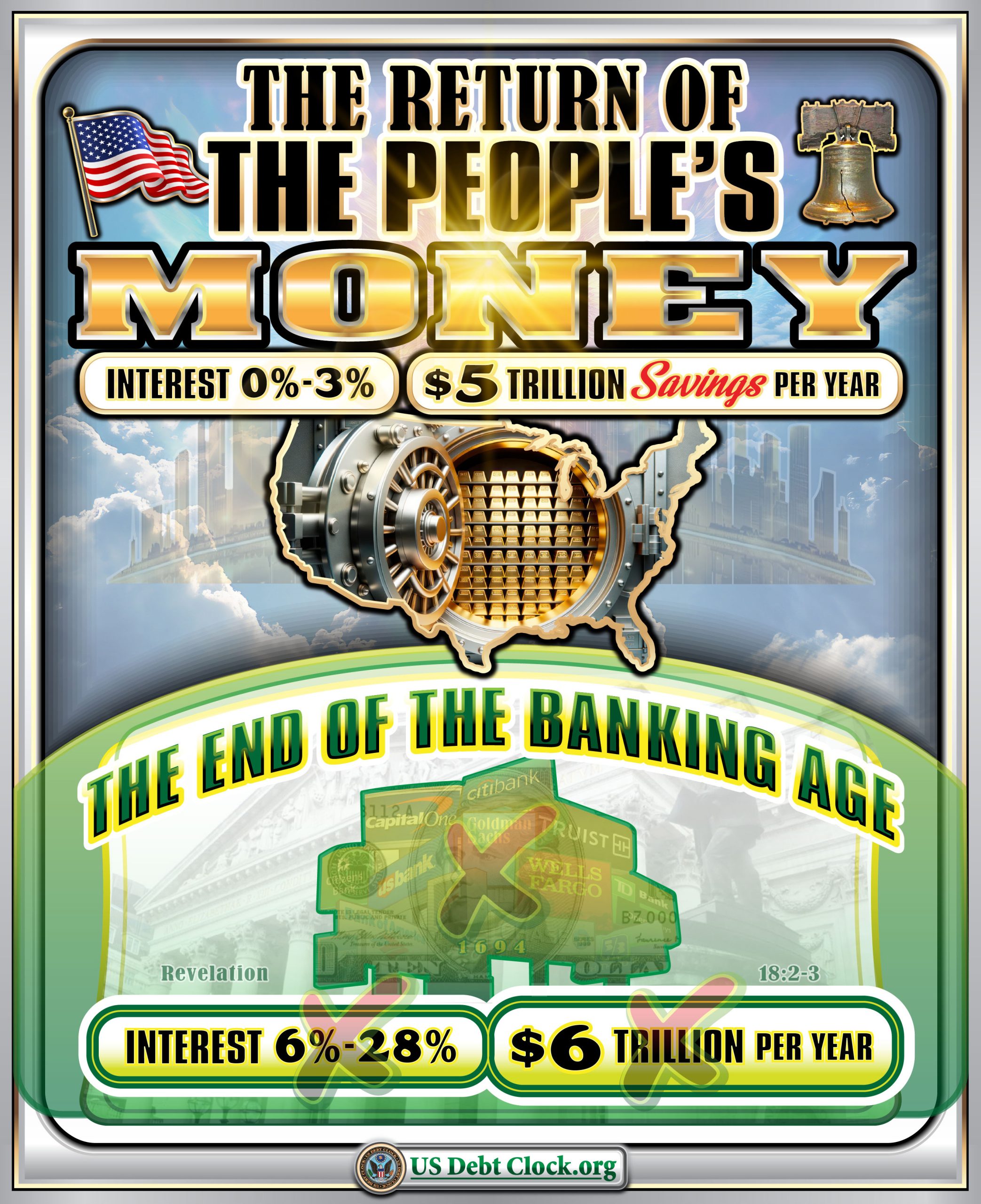

The Return of the People’s Money and End of the Banking Age

The tide has turned. The Age of the Bankers is closing its last ledger, and the Age of the Treasury—the people’s money—is roaring in like a storm with Donald J. Trump at the helm. On January 30, 2026, Trump made the kind of move that sends shivers down K Street’s spine and rattles the foundations…

-

Trump Declares National Emergency Over Cuba’s Support for U.S. Adversaries

President Trump signed an executive order Thursday declaring a national emergency over Cuba’s support for what the administration calls “malign actors adverse to the United States.” The order names Russia, China, Iran, Hamas, and Hezbollah. The language is blunt. “Cuba blatantly hosts dangerous adversaries of the United States,” the directive states. It says these actors…

-

Peace, Prosperity, and Radical Reform: Signals of a Potential Golden Era

📊 Invest Offshore News Brief — January 2026 US Debt Clock Sparks Talk of Radical Economic Reform A controversial posting circulating on USDebtClock.org and shared widely on social platforms has ignited heated debate about what some are calling “The End of Property Tax” in the United States and a proposed overhaul of the financial system.…

-

Spending New Money Into Circulation — Not Lending It

Why Treasury Certificates Change Everything For more than a century, the global financial system has operated on a fundamental flaw that few people ever stop to question: Almost all money enters circulation as debt. Not earned.Not saved.Not invested productively first. But lent — into existence — through fractional reserve banking, carrying interest that mathematically can…

-

The Two Assets That Best Meet 2026’s Global Needs

Why Gold and XRP together form the most neutral, honest monetary stack of the next era As we move deeper into 2026, the global financial system is no longer suffering from a lack of innovation. It is suffering from a lack of trust. Currencies are issued by indebted sovereigns. Settlement systems are controlled by intermediaries.…

-

The Great Silver Breakout

For more than a century, silver has been quietly telling a story that few have bothered to calculate properly. Not the paper price quoted on COMEX screens, not the derivative-laden futures market, but the real ratio between money creation and physical metal. When you run the math honestly, the result is startling—and it explains why…