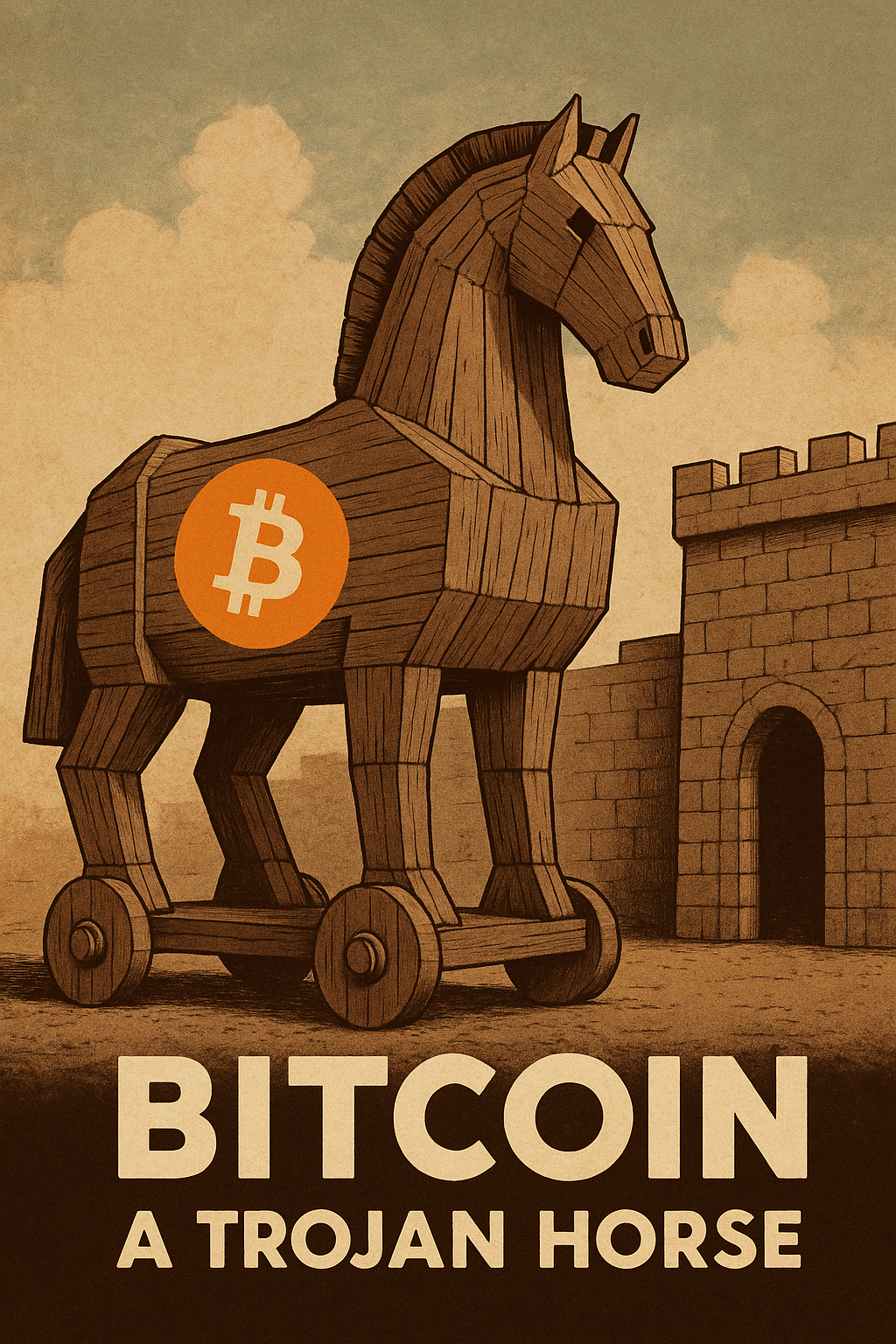

In the world of offshore finance and digital assets, Bitcoin is often celebrated as a decentralized, apolitical alternative to fiat currency. But beneath the surface of its origin story and cryptographic allure lies a troubling possibility: what if Bitcoin wasn’t a grassroots monetary revolution at all, but rather a sophisticated surveillance tool birthed in the shadows of government research?

Multiple sources over the past decade have raised suspicions that Bitcoin may have originated from the U.S. Department of Defense, specifically DARPA—the Defense Advanced Research Projects Agency. The codebase, the SHA-256 hashing algorithm, and the suspiciously clean launch (without any known involvement of nation-state actors at the time) have all led some researchers to question the mainstream narrative. Was Bitcoin a Trojan horse to draw black market participants, dissidents, and offshore capital into a fully traceable public ledger?

While proof remains elusive, Bitcoin’s early history shows extensive usage by dark web marketplaces such as Silk Road—allegedly watched and at times even enabled by Western intelligence agencies. In fact, law enforcement around the world have often boasted about how Bitcoin’s transparent blockchain made their investigations easier, not harder. Far from being untraceable, Bitcoin appears almost tailor-made for global intelligence work.

Further suspicions arise when we look at Mt. Gox, the once-dominant Bitcoin exchange. In 2014, it collapsed after declaring 850,000 BTC “lost” to hackers. While some of that BTC was later recovered, the breach exposed many large wallets—so-called “Whale” accounts—with vast, unexplained BTC holdings. If there were ever a moment to abandon the blockchain due to a catastrophic compromise, that was it. Yet, the crypto world carried on, absorbed the blow, and doubled down.

But here’s where things get especially murky: Many of those exposed Whale wallets remain dormant to this day. Some have not moved a single satoshi in over a decade. The questions write themselves—who owns those wallets? Are they truly lost forever, or are they simply inactive, waiting to be unleashed at a politically or financially strategic moment?

If Bitcoin’s original distribution was indeed manipulated or seeded by intelligence agencies or large covert actors, then its decentralization is more myth than reality. This isn’t just a philosophical concern—it’s a market risk. Should a few of these dormant Whales decide to move their coins, or worse, dump them onto the market en masse, it could trigger a catastrophic drop in price. Given Bitcoin’s relatively illiquid market depth at high volumes, a coordinated Whale exit could shake investor confidence permanently.

For offshore investors, especially those leveraging Bitcoin as a hedge against fiat debasement or as part of a diversified asset protection strategy, these risks cannot be ignored. The origin story matters. The distribution matters. And the dormant supply—controlled by unknown entities—matters a lot.

As always, Invest Offshore recommends maintaining exposure to a variety of asset classes including physical gold, offshore real estate, and tokenized private equity—not just cryptocurrencies. Diversification is the best defense against what you don’t know.

Because in the case of Bitcoin, it’s not just about what we know. It’s about what’s still hidden in the blockchain’s long, silent shadows.

Leave a Reply