Offshore Investing Guide

We understand that preserving and growing your wealth on a global scale presents both unique opportunities and complexities.

Invest Offshore Blog Posts

-

After the Flames: How the Palisades Fire Reshaped LA County Real Estate

The January 7, 2025 Palisades Fire — ignited in the Santa Monica Mountains and coupled with the Eaton Fire — was one of the most destructive wildfire events in Los Angeles County history. Together, these blazes burned more than 37,000 acres and destroyed over 16,000 structures, including more than 11,000 homes. The human toll was…

-

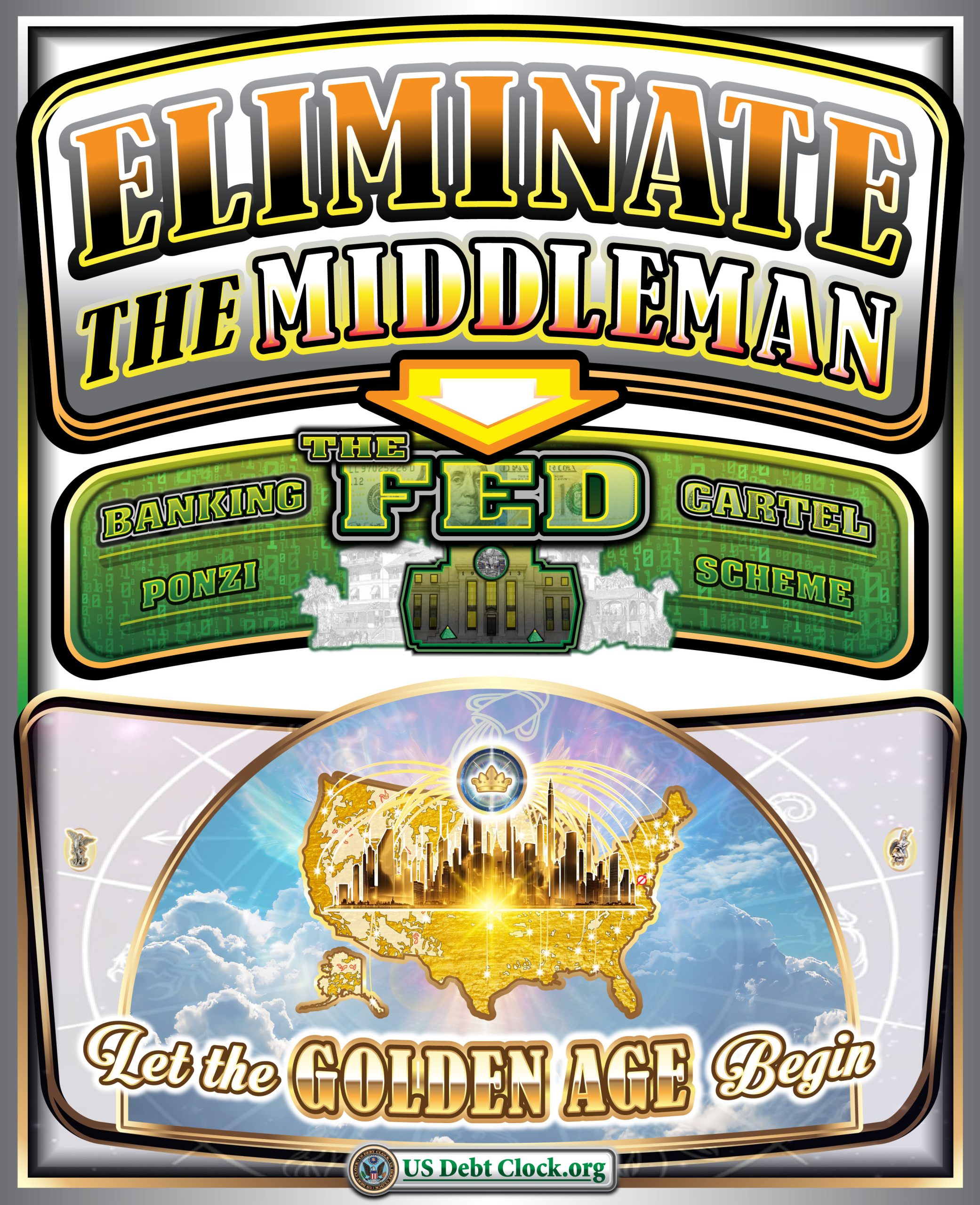

Spending New Money Into Circulation — Not Lending It

Why Treasury Certificates Change Everything For more than a century, the global financial system has operated on a fundamental flaw that few people ever stop to question: Almost all money enters circulation as debt. Not earned.Not saved.Not invested productively first. But lent — into existence — through fractional reserve banking, carrying interest that mathematically can…

-

Asset Protection: Even Google’s Founders Have Had Enough of California—and Are Saying Adiós

California was once the unquestioned capital of innovation, capital formation, and entrepreneurial freedom. Today, it is becoming a case study in what happens when success is treated as a public utility. In the days leading up to Christmas, Google founders Larry Page and Sergey Brin quietly began unwinding portions of their California-based financial empires, according…

-

Top 5 Offshore Corporation Jurisdictions in 2026

Where Global Capital Still Incorporates with Confidence Despite endless headlines about “crackdowns,” offshore corporations are not disappearing. They are consolidating into fewer, stronger jurisdictions—places with legal certainty, respected courts, treaty access, and regulators that understand international business. In 2026, offshore incorporation is no longer about secrecy. It is about jurisdictional arbitrage: choosing the right legal…

-

The Global Cash Pallet Redemption Permit Holder: A Little-Known Gatekeeper to Institutional Liquidity

In the shadows of global finance exists a role so specialized that most market participants have never heard of it—yet sovereigns, central banks, and Tier-1 institutions know it well. This role is known as the Global Cash Pallet Redemption Permit Holder, acting as an Authorized Representative to Institutional Buyers. It is not retail finance. It…

-

Lloyds Bank: Why It Remains a Top Choice in Offshore Banking

When investors and global citizens think of trusted financial institutions with deep heritage and modern capabilities, Lloyds Bank consistently ranks near the top — not just in the UK, but in the offshore banking world. For investors exploring secure, sophisticated, and globally respected banking partners, Lloyds’ longstanding reputation and evolving service offerings make it a…

-

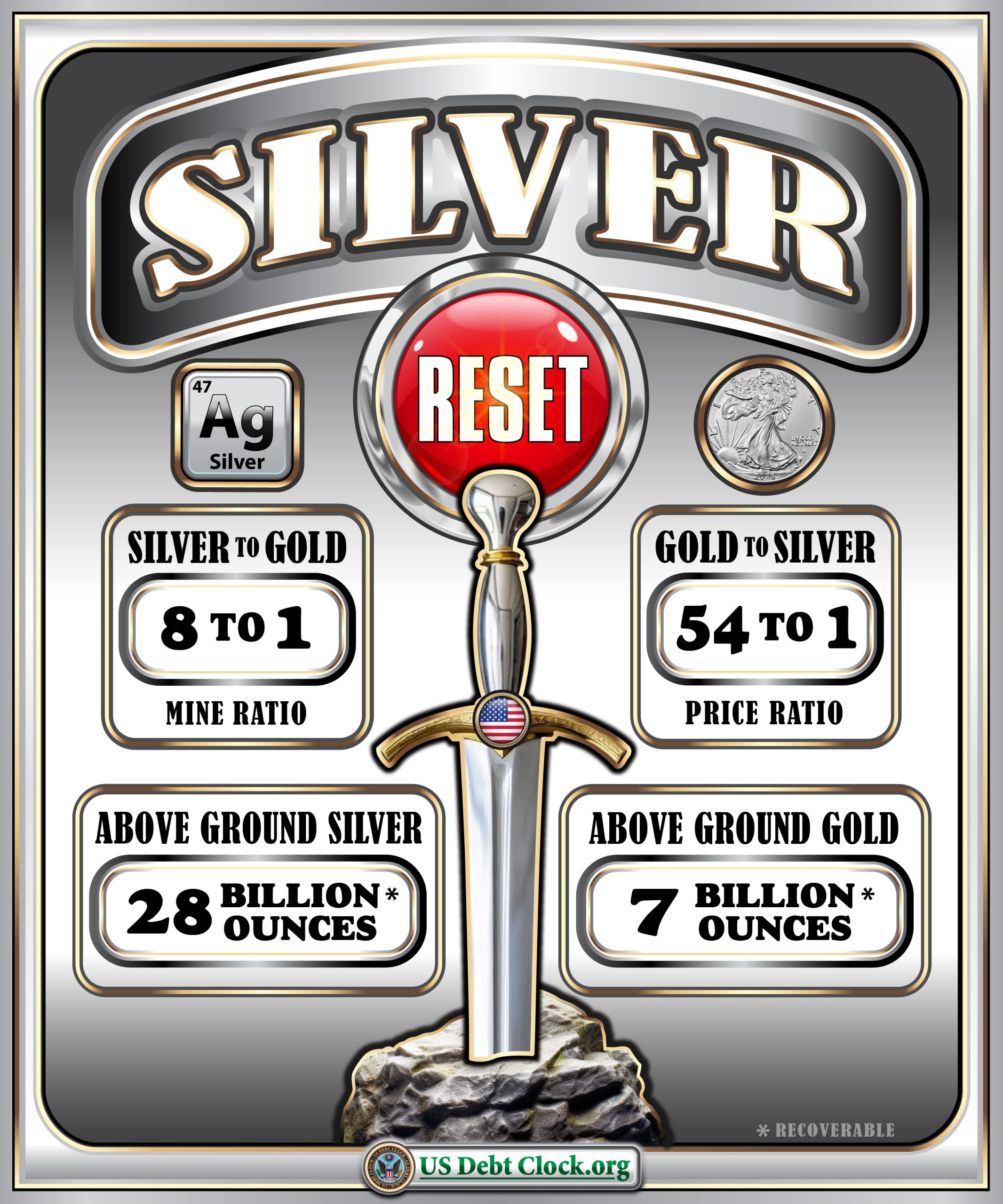

The Two Assets That Best Meet 2026’s Global Needs

Why Gold and XRP together form the most neutral, honest monetary stack of the next era As we move deeper into 2026, the global financial system is no longer suffering from a lack of innovation. It is suffering from a lack of trust. Currencies are issued by indebted sovereigns. Settlement systems are controlled by intermediaries.…

Join 900+ subscribers

We adhere to the highest privacy standards, ensuring that your personal information is treated with the utmost respect and confidentiality.