Tag: Isle of Man

-

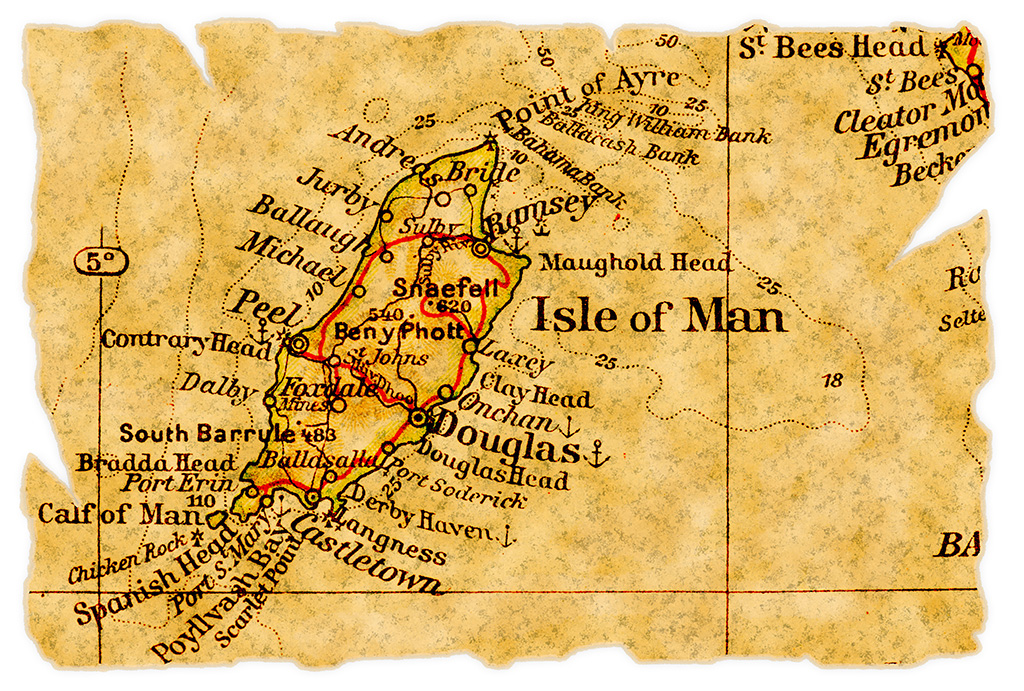

Isle of Man’s 3% Growth Ambition: £1B Investment, 5,000 New Jobs — and the Quiet HNWI Tailwind

The Isle of Man is making a deliberate bet: invest roughly £1 billion to lift trend growth toward ~3%, create 5,000 new jobs, and expand the working population enough to keep the Island’s public finances, services, and living standards moving in the right direction. That’s not just “economic development speak.” It’s a survival plan for…

-

Chartering a Private Offshore Bank for Infrastructure Funding via Private Placement Platforms

In today’s rapidly evolving financial landscape, investors and high-net-worth individuals are constantly searching for secure, efficient, and scalable options to support large-scale infrastructure projects. One such innovative solution is chartering a private offshore bank specifically tailored for infrastructure funding through Private Placement Platforms (PPPs). This approach not only provides significant financial leverage but also offers…

-

These Are The World’s Top 10 Tax Havens

Individuals and corporations use tax havens to minimize their tax burdens and protect their wealth in low-tax or no-tax jurisdictions. This graphic, via Visual Capitalist’s Bruno Venditti, shows the top 10 countries hosting the most offshore financial wealth, according to 2022 data from the Atlas of the Offshore World. What Is a Tax Haven? A tax haven offers…

-

Offshore Financial Services in the Channel Islands

Understanding the Appeal for Investors In the waters of the English Channel off the French coast of Normandy lie the Channel Islands, a group of British Crown Dependencies that have become renowned for their sophisticated offshore financial services. The two primary jurisdictions, Jersey and Guernsey, are well-known tax havens, offering a range of financial services…

-

Digital Nomads and Offshore Investing

A Guide to Location Independent Wealth Management The advent of the internet and the ability to work from anywhere has given rise to a new class of professionals: digital nomads. These location-independent workers, who leverage technology to perform their jobs from any corner of the globe, require unique solutions for managing and growing their wealth.…

-

Why the Isle of Man is NOT a tax haven

Forty-two years ago when former assessor of income tax Mark Solly published ’The Isle of Man: Anatomy of a Tax Haven’, tax havens were places where there was lower taxation than you had at home, where you could set up your trading company or family trust or even move in yourself. The motivation of those…

-

Isle of Man named International Finance Centre of the Year

The Isle of Man has won the award for International Finance Centre of the Year at the International Adviser Product and Service Awards. Local companies Ardan International, Nedbank and Momentum Pensions also took home awards. Martyn Perkins MHK, Member of the Department of Economic Development with responsibility for Financial Services, commented: ‘The Isle of Man…

-

Standard Bank helps clients bank smarter offshore

Standard Bank Group has enhanced its banking app to allow Offshore Group customers access to their offshore accounts while they are on the move. The app allows account holders to view balances and transaction history on a smartphone, and also make cross-currency payments between their Standard Bank accounts. New features released in the future will…

-

British Overseas ‘Tax Havens’ Warned by UK

LONDON, England — A Labour government would push for UK overseas territories to be put on an international blacklist if they refuse to co-operate with a drive against tax avoidance, Labour Party leader Ed Miliband has told them ahead of general elections in Britain in May. In a letter to the leaders of British Overseas…