Category: Tax Havens

-

Great Wealth Migration Accelerates With 35% of HNWIs Eyeing Lower-Tax Havens

deVere Group’s data reveals that over a third of wealthy clients are rethinking their residency for tax relief and stability—part of a deliberate ‘Great Wealth Migration’ from the UK, Europe, and beyond. High-net-worth individuals (HNWIs) are voting with their feet—and fortunes—as global fiscal landscapes shift. New deVere Group findings show that 35% of its 80,000…

-

The Good, the Bad, and the Ugly of Comoros as an Offshore Tax Haven

In the world of offshore finance, attention usually gravitates toward familiar jurisdictions such as Cayman, BVI, Panama, or Seychelles. Yet quietly sitting in the Indian Ocean, off the coast of East Africa, the Union of the Comoros (UoC) occasionally appears on radar screens as an “emerging” offshore jurisdiction. Comoros is a small, three-island archipelago covering…

-

Delaware: America’s Oldest Corporate Safe Harbor

When Larry Page, co-founder of Google and a principal force behind Alphabet, quietly shifts his corporate base to Delaware, it sends a clear signal. For founders, boards, and global investors alike, Delaware remains the safest jurisdiction in America to run a large enterprise with peace of mind. Delaware’s appeal has nothing to do with size.…

-

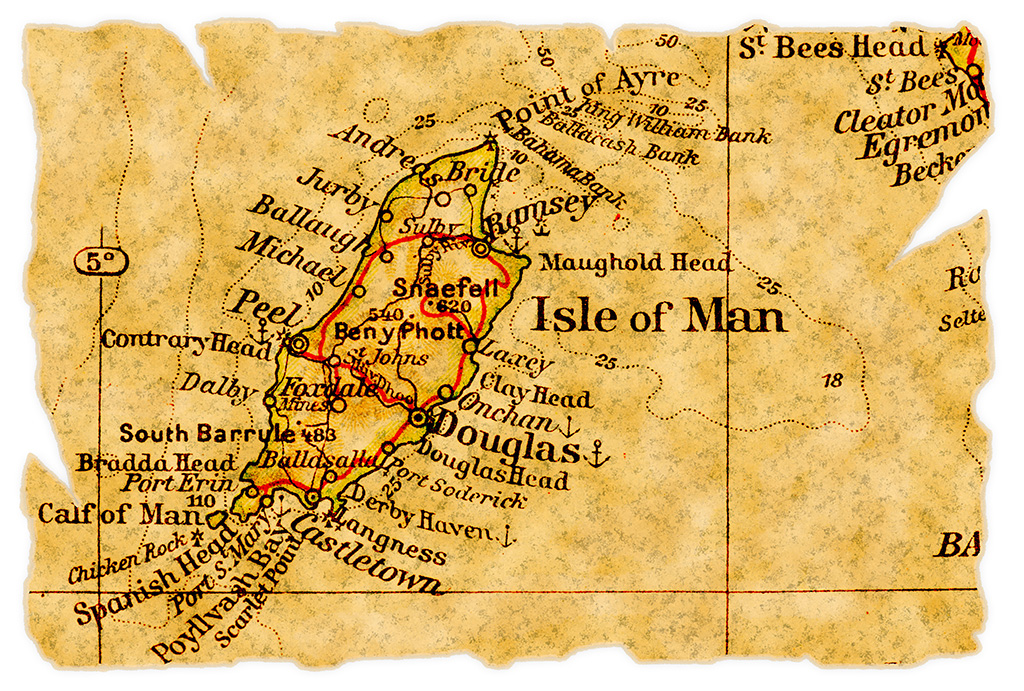

Isle of Man’s 3% Growth Ambition: £1B Investment, 5,000 New Jobs — and the Quiet HNWI Tailwind

The Isle of Man is making a deliberate bet: invest roughly £1 billion to lift trend growth toward ~3%, create 5,000 new jobs, and expand the working population enough to keep the Island’s public finances, services, and living standards moving in the right direction. That’s not just “economic development speak.” It’s a survival plan for…

-

Top Tax Havens of 2025: Where Offshore Capital Thrives in a Fragmenting Global Economy

In 2025, the global tax landscape is being reshaped by geopolitics, digital mobility, rising sovereign debt, and an unprecedented flight of private capital seeking stability. As OECD pressure intensifies and governments hunt for revenue, the classic offshore jurisdictions are not fading—they’re evolving. Today’s top tax havens combine zero-tax frameworks, political stability, financial privacy, and increasingly…

-

Crypto’s Tax Haven Era is Over: IRS Launches Major Crackdown Starting with 2025 Filings

For more than a decade, crypto investors enjoyed something close to a digital tax haven—complex, anonymous, and largely unpoliced. That era has officially ended. The IRS has launched one of the most aggressive reporting crackdowns in the history of U.S. taxation, and it begins with the 2025 filing year. The Treasury Department is explicitly targeting…

-

Alaska: America’s Quiet Tax Haven for the Financially Savvy

When most people think of U.S. tax havens, states like Florida, Texas, or Nevada often come to mind. Yet Alaska—remote, resource-rich, and remarkably independent—stands out as one of the most unique and underappreciated jurisdictions for wealth preservation in America. Its fiscal framework is designed not just for rugged survival, but for financial optimization. No State…

-

Puerto Rico: Beyond “America’s Island” — A Strategic Outlook for Offshore Investors

When one thinks of Puerto Rico, often what comes to mind is a tropical island, a U.S. territory, a destination for tourism and U.S. mainland vacationers. But as the Las Vegas Sun op-ed reminds us, Puerto Rico can — and should — be considered much more than merely “America’s” annexed leisure spot. It has the…

-

Luxembourg Emerges as Europe’s Digital Asset Powerhouse

In the past year, Luxembourg has rapidly evolved into one of Europe’s most dynamic hubs for digital finance. Already renowned as a center for fund management and cross-border finance, the Grand Duchy is now attracting some of the most influential players in the crypto and tokenisation space. Big Names Move In Crypto giant Coinbase has…