Category: Stocks and Bonds

-

Why Investors Like Junior Producers: Small Caps, Big Torque

When investors talk about mining “sweet spots,” junior producers often sit right in the middle of the risk–reward spectrum. They’re no longer pure speculation (like early exploration juniors), but they’re not yet “slow-moving ships” (like major miners). They produce metal today—and they still have meaningful runway to grow. That combination is exactly why junior producers…

-

Luxembourg Green Bonds and Ireland: Europe’s Clean-Capital Pipeline

If you’re trying to understand where serious sustainable capital actually gets raised in Europe, two places keep showing up—again and again—far out of proportion to their size: Luxembourg and Ireland. One is a global listing hub that essentially turned green bonds into a “transparent showroom.” The other built a sovereign green bond program that treats…

-

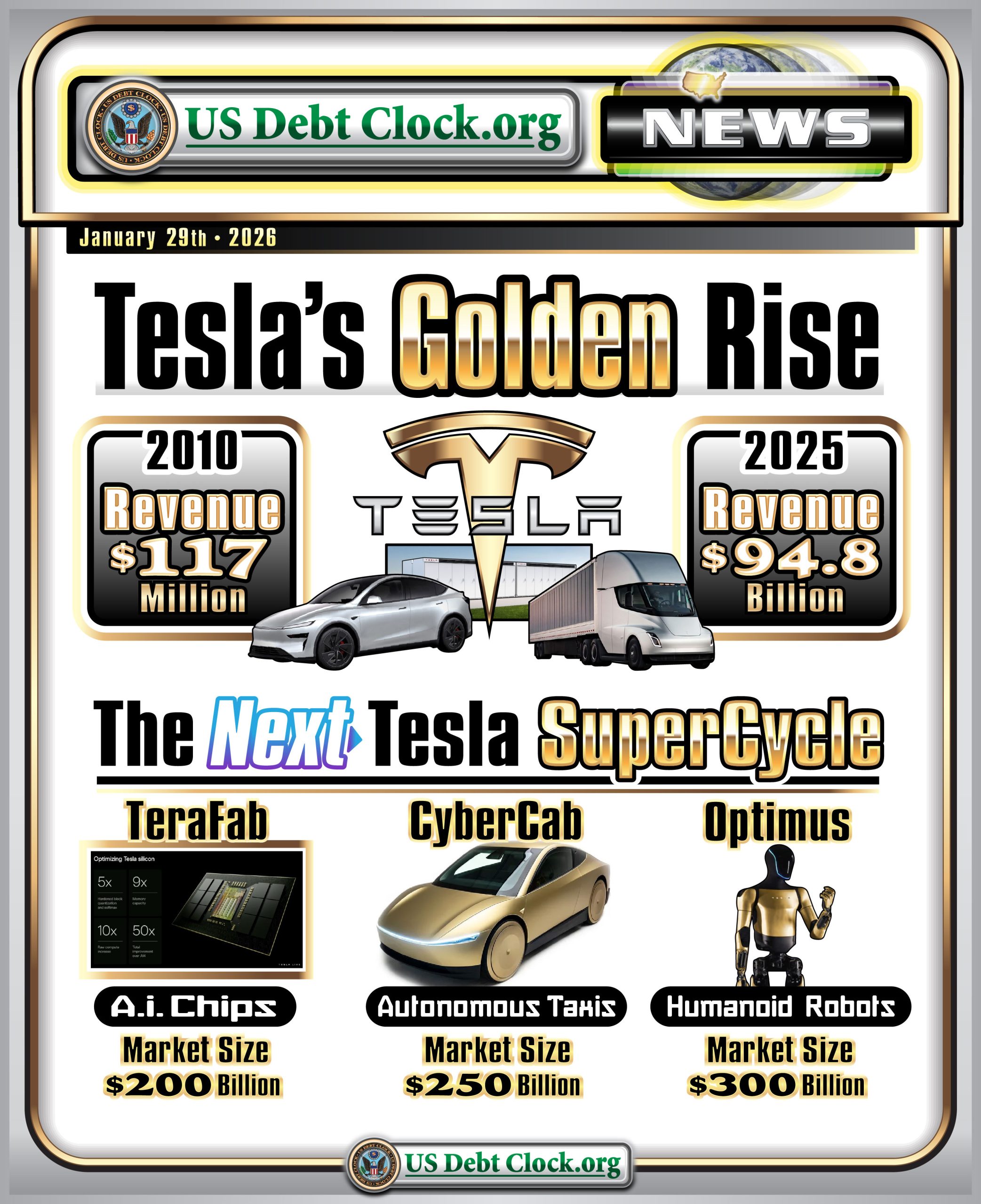

Tesla’s Golden Rise — and the “Next Tesla Super Cycle” the U.S. Debt Clock Is Hinting At

Today’s U.S. Debt Clock graphic is doing what it does best: compressing a decade-plus of disruption into one punchy visual. At the center is Tesla’s revenue arc — from roughly $116.7M in 2010 to $94.8B in 2025 — a reminder that “impossible” often just means “early.” Tesla’s own 2010 results pegged full-year revenue at $116.7M.…

-

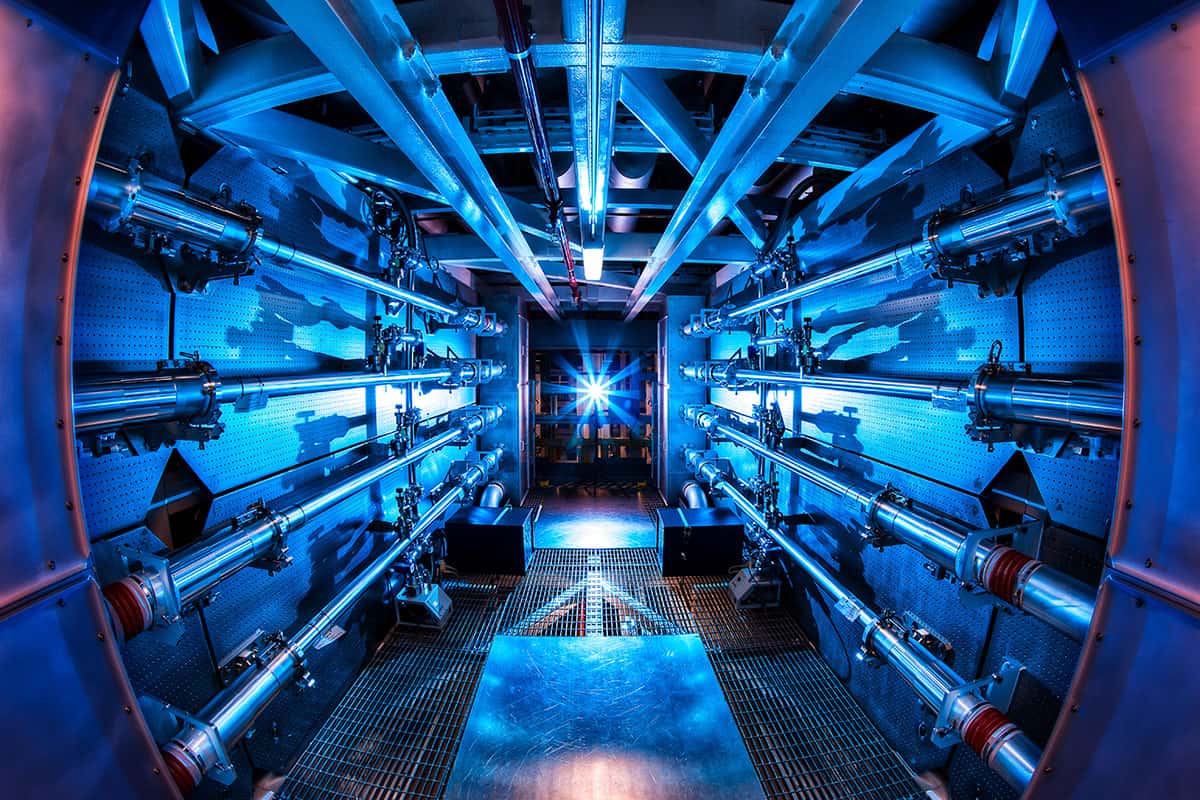

Invest Offshore Recommends Zero Hedge’s “Where The Department of Energy Is Investing”

Invest Offshore is recommending a timely and insightful analysis published by Zero Hedge, submitted by Tight Spreads, titled “Where The Department of Energy Is Investing.” The article cuts through the noise to explain why fusion energy is accelerating a quiet but massive U.S. push to securitize domestic rare earth and advanced-materials supply chains—and which companies…

-

Venezuela Reset: The Winners, the Losers, and the Canadian Oil Shorts No One Is Talking About

With Nicolás Maduro now captured and a transitional authority moving rapidly to normalize relations with Washington, Venezuela has entered what markets recognize instantly as a regime-reset trade. For investors, this moment is not about ideology—it is about supply shocks, capital flows, and repricing risk across global energy markets. Sanctions relief, U.S. corporate re-entry, and multilateral…

-

The Santa Claus Rally Begins

Authored by Lance Roberts via RealInvestmentAdvice.com, U.S. equity markets began the holiday‑shortened trading week on a firm footing. Broad gains in major indexes and the start of the Santa Claus rally marked this week. Following modest volatility in trading earlier in December, sentiment improved significantly as investors bet on year-end flows. As shown, the CNN…

-

XDNA and the Rise of Self-Sovereign Biology: Why DNA-Backed Identity Is the Next Frontier

The world is rapidly moving beyond passwords, plastic cards, and centralized identity databases. The next phase of the digital economy will be built on verifiable, self-sovereign identity (SSI)—and increasingly, that identity will extend beyond documents and devices to the most fundamental layer of all: biology itself. This is where XDNA, developed by DNA Protocol, enters…

-

Energy, Power and Suppression by Laura Aboli

Every civilization, without exception, is built on energy. Not ideology, nor money, it’s actually ENERGY that marks the difference between thriving or merely surviving. Who controls it, who distributes it, who decides its price, and who is allowed access to it, determines everything else that follows. We are now moving into a world that will…