Category: Precious Metals

-

Buscar Company is putting up for sale its wholly-owned subsidiary Gold Mining LLC for $3,500,000

Beverly Hills, California, Oct. 11, 2022 (GLOBE NEWSWIRE) — Buscar Company (OTC: CGLD) is putting up for sale its wholly owned subsidiary Gold Mining LLC for $3,500,000 that owns 30 unpatented claims consisting of 600 acres in Plumas County. The Plumas County claims were staked, recorded, and then moved into a wholly owned subsidiary to…

-

Former U.S. Mint Director Suggests We May Have Hit Peak Gold as Cost to Mine Skyrockets

AUSTIN, Texas, Sept. 28, 2022 /PRNewswire/ — Philip N. Diehl (35th Director of the U.S. Mint and President of U.S. Money Reserve) says “peak gold” may have already been reached or at the very least is fast approaching. Peak gold is the point at which the maximum rate of gold extraction is reached, after which mining will slowly decline…

-

Patriot Gold Group Expands it’s “2022 Inflation Protection IRA” With A Preferred Platinum Tier No Fee For Life IRA

“Wake me up when September ends” – Green Day LOS ANGELES, Aug. 25, 2022 /PRNewswire/ — September is fast approaching, and warnings of an aggressive rate hike are echoing the already worried, battered and beaten halls of Wall Street. According to BARRON’s and Wall Street the “S & P has averaged a 1% loss in September –…

-

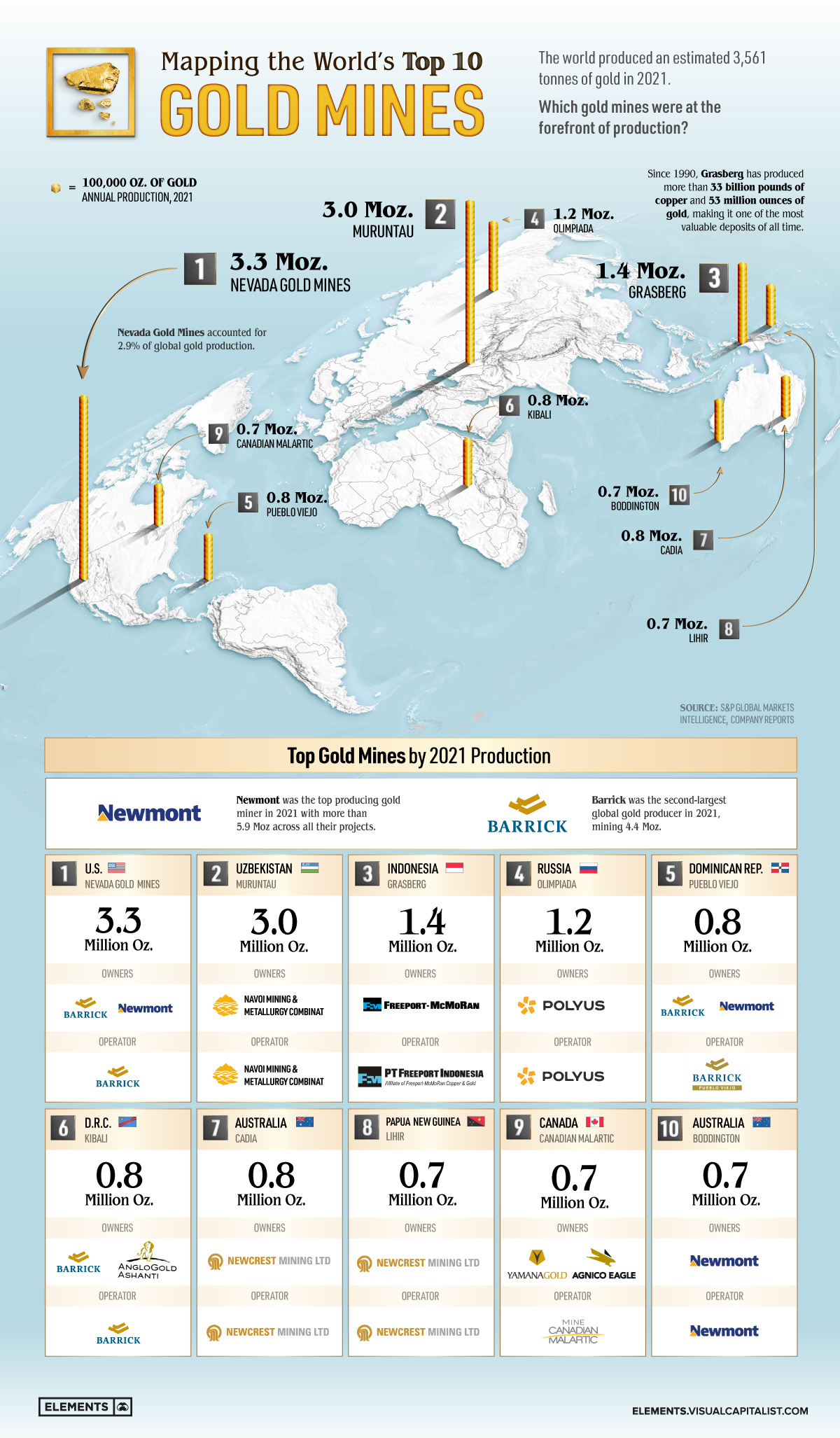

The 10 Largest Gold Mines in the World, by Production

Gold mining is a global business, with hundreds of mining companies digging for the precious metal in dozens of countries. But where exactly are the largest gold mines in the world? The above infographic uses data compiled from S&P Global Market Intelligence and company reports to map the top 10 gold-producing mines in 2021. Editor’s Note: The…

-

Dignity Gold Mining Claims Now Wholly Owned; Enhances Financial Reserves With Interest In Real Property

Dignity Gold Takes Crucial Next Steps to Demonstrate Control and Financial Support For its DIGau Precious Metal and Mineral Security NEW YORK, NEW YORK, UNITED STATES, April 21, 2022 /EINPresswire.com/ — Dignity Gold (Dignity), the United States-based digital security company that is taking a regulation-forward approach to using verified gold reserves to back its DIGau…

-

Nano Silver Market in India to Reach $208.2 Million by 2027 | CAGR: 21.3%: AMR

Increase in demand for nano silver from various antimicrobial applications in end use industries and rapid growth of the electronics and pharmaceutical sectors in the province drive the growth of the India nano silver market. By end-user, the electrical and electronics segment dominated the market in 2019, and is expected to maintain its dominance throughout…

-

Gold Silver Ratio and the U.S. Dollar

Gold Silver Ratio is a key indicator of a market that has been used by savvy traders to keep the price of silver low. Now with the short squeeze on silver ETF shares, and enactment of new regulations introduced in the Basel III agreements, (come into effect March 2021) the free market price discovery begins.…

-

Gold Mining Company Buscar Announces First Dore Bars Sent To Refinery

DENVER, Oct. 22, 2020 /PRNewswire/ — Buscar Company (CGLD) announced today that the Company has sent in approximately 219 grams (or approximately 7 troy ounces) of Dore Bars to be refined. The 219 grams represents approximately 750 pounds of rock ore that was crushed on site as the mining team awaits the arrival and setup of their heavy mining…

-

Gold Mining Company Buscar Provides Update on Plan of Operations

DENVER, Oct. 7, 2020 /PRNewswire/ — Buscar Company (CGLD) provided an update today on the company’s Plan of Operations filed with the US Forest Service in July of this year. CEO Alex Dekhtyar stated, “We are pleased with the progress being made at Treasure Canyon and we look forward to ramping up our operations once the Plan of Operations is approved…