Category: Precious Metals

-

The 20-Year Gold-Silver Ratio: Unraveling Precious Metal Market Insights

In the world of precious metals, the gold-silver ratio has long been a fascinating indicator for investors and traders. This ratio measures the relative value of gold to silver and has been used for centuries to identify potential market trends and investment opportunities. One of the most widely observed timeframes for this ratio is the…

-

Investing in Precious Metals: Methods, Risks, and Benefits

The age-old allure of precious metals like gold, silver, platinum, and palladium has stood the test of time. These valuable resources have long been a preferred investment choice for many, acting as a safe haven during volatile market conditions. However, just like any other investment, investing in precious metals has its own set of risks…

-

Safe Keeping Receipts (SKR) for African Gold Export

Safe Keeping Receipts (SKR) is one of the steps involved in West Africa Gold Export. An SKR is another bank instrument that is used as an alternative financing tool. These instruments can be issued from banks, bullion vaults, storage houses, or alternative financing facilities. Those that issue the SKR do not own them, so the asset…

-

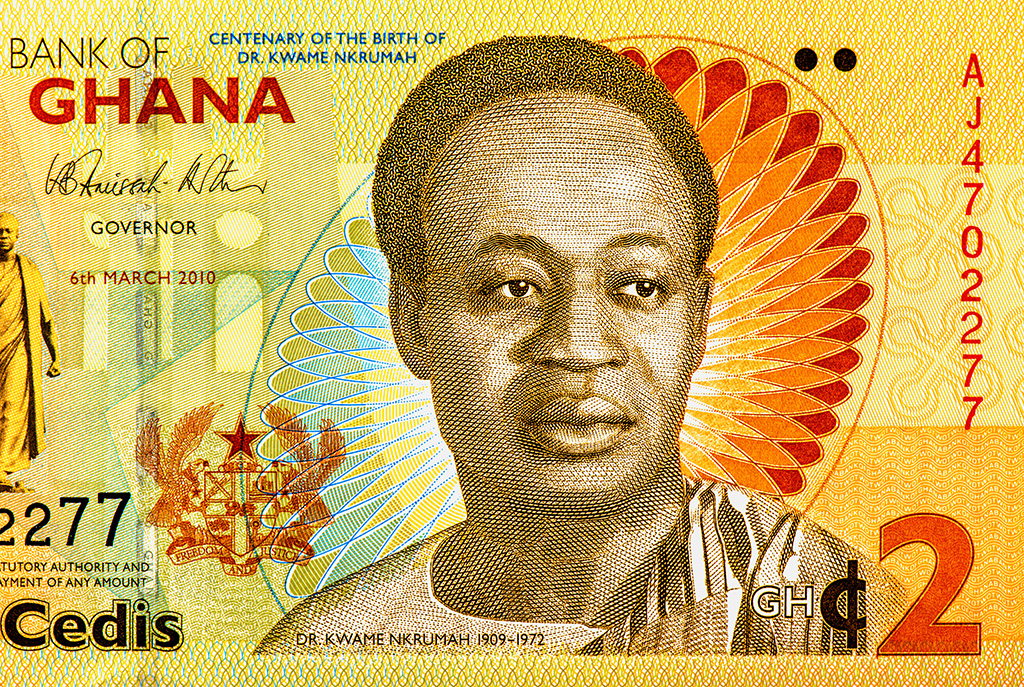

Ghana Gold Export of Doré Bars to Switzerland

Ghana Gold Export of 5kg of Doré Bars CIF vs FOB When it comes to international trade, CIF (Cost, Insurance, and Freight) and FOB (Free On Board) are two common terms used to define the responsibilities of buyers and sellers in the transaction. CIF means that the seller is responsible for the cost of the goods,…

-

Invest Offshore in Ghana Gold Export

How much Dore Gold does Ghana export? According to the World Gold Council’s report on gold production and exports, Ghana is the largest producer and exporter of gold in Africa. In 2020, Ghana produced 142 metric tonnes of gold and exported approximately 80% of it. However, the report does not provide specific information on the…

-

Ask AI; is Silver a Better Investment than Gold

Determining whether silver or gold is a better investment depends on various factors, including current market conditions, economic outlook, and individual investment goals. Historically, gold has been viewed as a safe-haven asset, particularly during times of economic uncertainty or inflationary pressures. It is widely traded and recognized globally as a store of value. Silver, on…

-

Gold Hallmarks for Gold Bullion Investment

Can Gold Bullion be deposited in a bank? Yes, gold bullion can be deposited in a bank. Many banks offer safe deposit boxes or vaults where customers can store their precious metals, including gold bullion. This service is often used by individuals or businesses that want to protect their valuable assets from theft, loss, or…

-

A record influx of IRA Rollovers into precious metals due to higher inflation and an increasingly volatile stock market states Orion Metal Exchange

LOS ANGELES, Feb. 3, 2023 /PRNewswire/ — Orion Metal Exchange, the top-rated precious metal company according to Retirement Living and Consumer Affairs, has reported a record number of IRA Rollovers where investors are switching from traditional paper investments into gold, silver, and platinum as a hedge against geo-economic uncertainty. This can be attributed to a combination of…

-

Macleod: The Upside-Down World Of Currency

Authored by Alasdair Macleod via GoldMoney.com, The gap between fiat currency values and that of legal money, which is gold, has widened so that dollars retain only 2% of their pre-1970s value, and for sterling it is as little as 1%. Yet it is commonly averred that currency is money, and gold is irrelevant. As…