Category: Precious Metals

-

Global Gold Offers at the Center of the Bullion Trade

In the highest tiers of the international bullion market, access is everything. There is a major difference between retail gold chatter and the real institutional flow of metal that moves through the world’s financial capitals. At the center of that world sits a brokerage house in Germany, positioned at the epicenter of the global gold…

-

Beyond the Yellow Metal: Why the AI Boom Runs on Gallium, Germanium, and Antimony

For decades, the “Offshore” playbook for wealth preservation was simple: move into hard assets, primarily gold and silver, and store them in jurisdictions with high rule-of-law and low fiscal desperation. But as we move deeper into 2026, the definition of a “safe haven” is evolving. While gold remains the ultimate insurance policy against currency debasement,…

-

America’s Lost Wealth Rediscovered. The Next Chapter Will Be Mined

On February 12, the US Debt Clock graphic (shared on usdebtclock.org) dropped a bold visual: “AMERICA’S LOST WEALTH — Rediscovered.” It’s framed like a vintage treasure poster—an eagle overhead, an American flag backdrop, and a golden map of the United States lit up with “nodes” like a mineral grid. In the lower corner, a prospector…

-

Silver: From Suppression to Surge — Confessions of a Silver Spoofer

For decades, silver has been dismissed as the “forgotten metal.” Too volatile. Too manipulated. Too small to matter. And yet, quietly, relentlessly, silver has become one of the most strategically important industrial metals on Earth. A recent first-person testimony circulating among precious-metals professionals sheds rare light on why silver stayed cheap for so long —…

-

Why Paper Gold Is a Trap

Paper gold was never designed to protect you.It was designed to control you. For decades, investors have been told they “own gold” because a brokerage statement says so. ETFs, futures, unallocated accounts, synthetics—layers of paper promises stacked on top of a finite physical metal. That works…until it doesn’t. And when it doesn’t, paper holders discover…

-

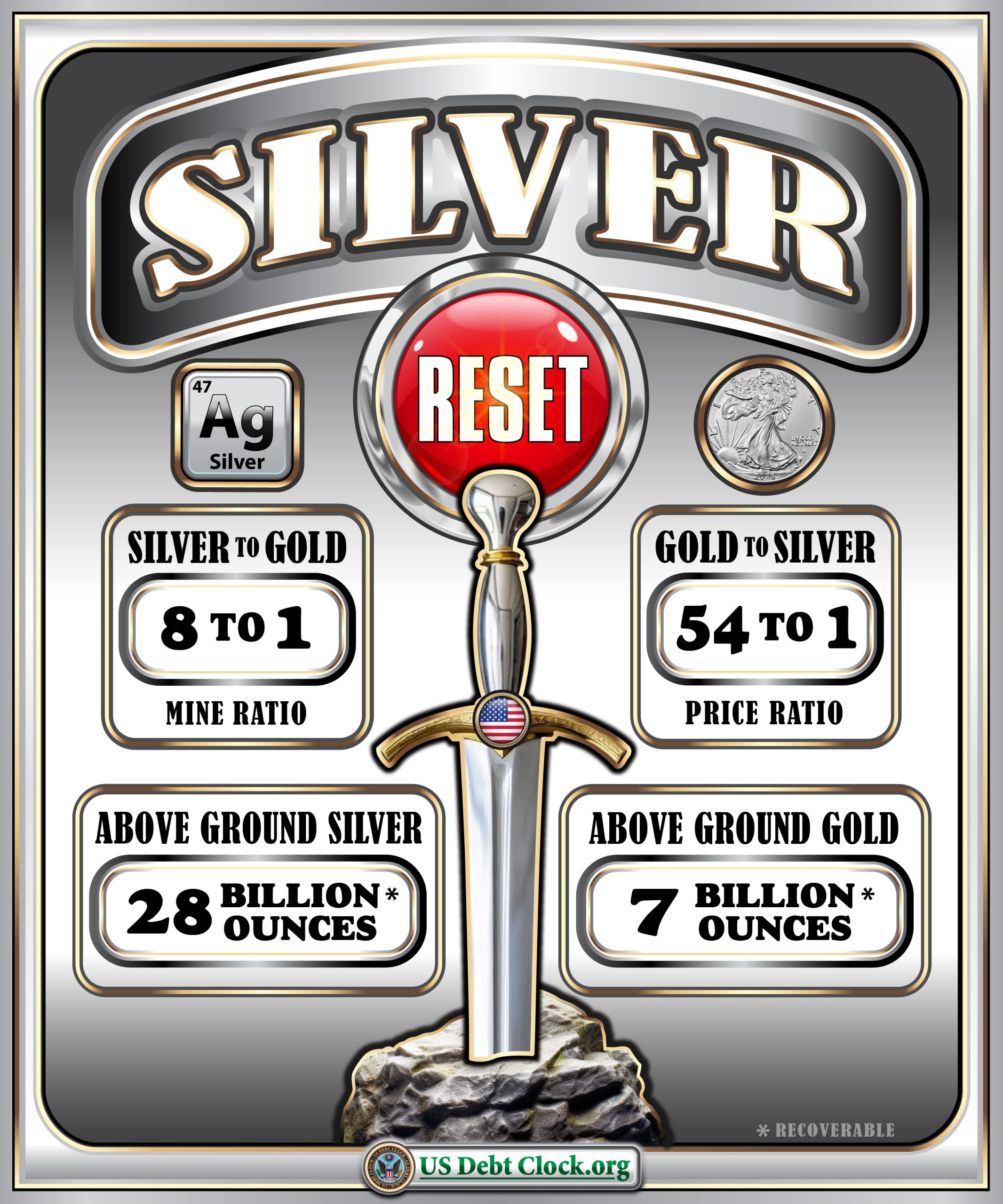

The Silver Reset Is Here — And Why NI 43-101 Will Decide Whether Canada Can Rise From 14th Place to Compete With the Top Producers

Silver doesn’t reset like a speculative asset.It resets the way a pressure valve releases: slowly at first, then all at once. Industrial demand is no longer optional. Solar, electrification, defense systems, AI hardware, and advanced electronics all depend on silver’s unmatched conductivity. At the same time, mine supply growth has lagged demand for years. This…

-

The Shanghai Silver Benchmark (SHAG): Why China May Now Set the Real Price of Silver

For decades, global silver pricing has been dominated by Western financial centers — primarily London’s LBMA spot pricing and New York’s COMEX futures. But quietly, and steadily, a different pricing center has emerged. One grounded not in leverage and paper contracts, but in physical metal, domestic demand, and real settlement. That center is China. At…

-

The Silver Shock That Will Hit Canada First — And No One Is Ready

Canada has long been a resource powerhouse, from oil and lumber to potash and precious metals. But a growing number of analysts are now pointing to a looming silver shock—a dramatic market upheaval in the silver market that they say Canada will feel first. According to a recent report by CAD Financial News, this silver…

-

Seeking Investors for a Promising Gold Venture in Tanzania’s Tanga Region

A compelling opportunity has emerged from East Africa’s fast-growing gold corridor, where a junior mining firm operating in Tanzania’s Tanga Region is seeking a strategic investor to accelerate production and scale operations. For offshore investors looking to participate in the continent’s next chapter of gold development—before the majors arrive—this is precisely the profile many look…