Category: Offshore Banks

-

World Bank Bureaucrats Lose Track of $24 Billion in Climate Funds: Comedy or Catastrophe?

The World Bank, an institution with a storied history of bureaucracy and questionable financial oversight, has outdone itself yet again. This time, it’s not just millions of dollars misplaced or misallocated — it’s a jaw-dropping $24 billion of climate change funds that have apparently wandered off into the financial ether. And here’s the kicker: that…

-

Africa’s Best Private Banks 2025

Africa Offshore Investments Hedge Against Currency Volatility Wealth preservation and growth remain formidable challenges for Africa’s affluent, particularly in today’s volatile macroeconomic environment. High inflation, currency instability, and foreign exchange scarcity have eroded wealth across the continent, leaving high-net-worth individuals (HNWIs) seeking reliable strategies to protect and grow their assets. The Case for Offshore Investments…

-

How European Banks Leverage Tax Havens: A Persistent Practice Despite Transparency Measures

In the world of asset protection and offshore finance, there is one trend that refuses to fade: European banks channeling substantial profits through tax havens. Despite ongoing efforts for transparency and stricter disclosure regulations, the largest European banks continue to book a staggering EUR 20 billion—equivalent to 14% of their total annual profits—in offshore jurisdictions.…

-

TD Bank Pleads Guilty to Bank Secrecy Act and Money Laundering Conspiracy Violations in $1.8B Resolution

WASHINGTON — TD Bank N.A. (TDBNA), the 10th largest bank in the United States, and its parent company TD Bank US Holding Company (TDBUSH) (together with TDBNA, TD Bank) pleaded guilty today and agreed to pay over $1.8 billion in penalties to resolve the Justice Department’s investigation into violations of the Bank Secrecy Act (BSA) and…

-

Chartering a Private Offshore Bank for Infrastructure Funding via Private Placement Platforms

In today’s rapidly evolving financial landscape, investors and high-net-worth individuals are constantly searching for secure, efficient, and scalable options to support large-scale infrastructure projects. One such innovative solution is chartering a private offshore bank specifically tailored for infrastructure funding through Private Placement Platforms (PPPs). This approach not only provides significant financial leverage but also offers…

-

London-Listed Banks Fall on Tax Fears: Investors React to Potential Budget Levies

London’s financial markets were rattled recently as shares in major UK banks, including NatWest, Barclays, and Lloyds, took a sharp downturn. The sell-off was driven by growing investor anxiety over potential tax hikes in the upcoming budget, raising concerns about the impact on the banking sector’s profitability and the broader investment landscape. The Market Reaction:…

-

Offshore Banking’s Rise Amid the Ongoing Dollar Crisis

In the ever-evolving landscape of international finance and currency markets, offshore banking has gained significant prominence, especially in light of the ongoing dollar crisis. This trend highlights the crucial role offshore banking plays in the global financial system, particularly in maintaining the dominance of the US dollar. The Rise of Offshore Dollar Use Offshore use…

-

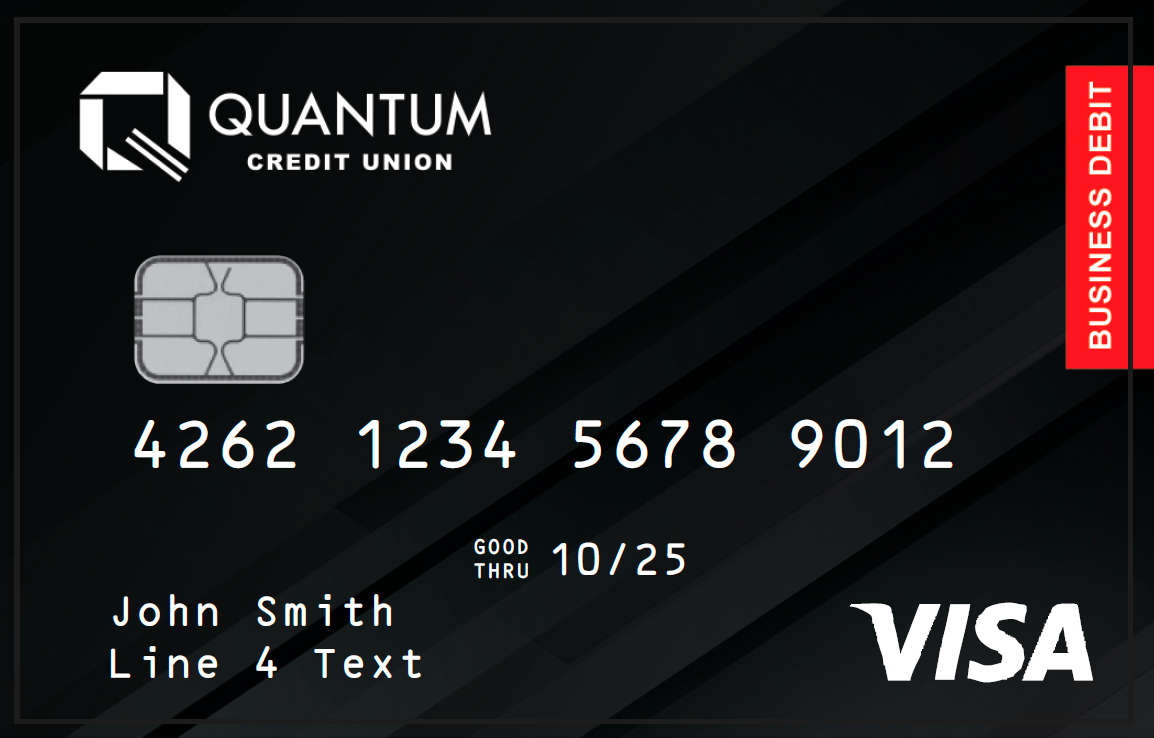

Exploring the Quantum Visa Credit Card: A Standout Option for Everyday Spending

When it comes to choosing a credit card, finding the right balance between rewards, fees, and flexibility is key. The Quantum Visa credit card distinguishes itself in this competitive market with a range of features designed to offer both value and convenience, making it a strong contender for those who prioritize everyday spending without the…