Category: Offshore Banks

-

Top 10 Private Banks in 2025: Global Gateways to Wealth for HNWIs

In 2025, private banking remains the cornerstone of wealth preservation, legacy planning, and bespoke financial services for high-net-worth individuals (HNWIs). The world’s leading private banks have elevated their offerings through innovation, sustainability, and personalized advisory—all while maintaining discretion and global reach. Whether you’re a newly minted millionaire or an established ultra-high-net-worth individual (UHNWI), choosing the…

-

Crypto PPP: Emphasizing Wallet Control, Asset Origin & KYC Compliance in Ethereum-Based Private Placement Programs

As the world of high finance adapts to the digital asset revolution, Private Placement Programs (PPPs) are no longer exclusive to fiat currencies and traditional banking instruments. Ethereum (ETH), one of the most widely held and liquid digital assets, is now finding its place in structured trade platforms and Tier 1-level investment procedures. However, navigating…

-

How to Open an Offshore Bank Account with a Prepaid Debit Card: A Guide for Individual Investors

Opening an offshore bank account as an individual is no longer the exclusive realm of corporate elites or multimillionaires. In today’s digital age, individuals from nearly any country can legally open an offshore account online—often with as little as $500—and receive a prepaid debit card for everyday use or travel. This financial tool provides privacy,…

-

Secure Offshore Wealth with Our €100 Million SBLC Opportunity – Now Available via Invest Offshore

Secure Offshore Wealth with Our €100 Million SBLC Opportunity – Now Available via Invest Offshore In today’s climate of economic volatility and currency uncertainty, asset-backed financial instruments remain one of the most strategic vehicles for protecting and growing offshore wealth. Invest Offshore is pleased to present an exclusive opportunity for sophisticated investors: a non-recourse, high-LTV…

-

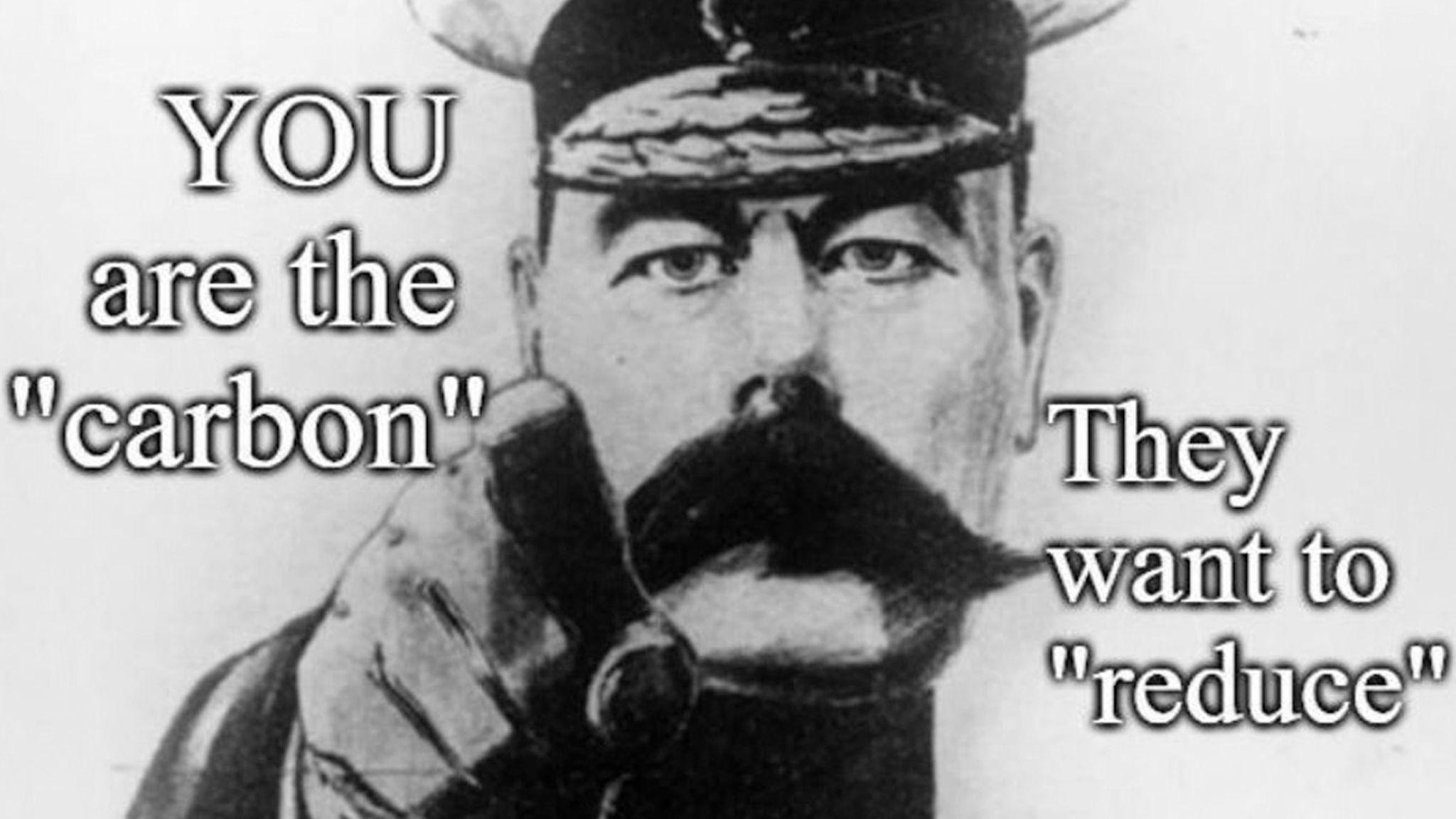

Climate Crisis Hoax? Major Banks Exit Net-Zero Alliance, Shaking Climate Finance Foundations

In a seismic shift that has rocked the foundations of global climate finance, six of the largest U.S. banks and all major Canadian banks have quietly exited the Net-Zero Banking Alliance (NZBA). While these institutions insist their climate commitments remain intact, their departure has exposed deep cracks in the once-glossy narrative of unified decarbonization goals.…

-

Tether USDT Dominates Trade in the New BRICS Economic Bloc

As the BRICS alliance evolves into a formidable economic bloc—expanding its influence across Asia, Africa, South America, and the Middle East—one financial instrument has quietly become the backbone of cross-border trade: the Tether stablecoin (USDT). With nearly $200 billion in daily trade settlements, Tether now stands as the most actively used cryptocurrency in the world,…

-

The BIS’s Role in Controlling and Monitoring Private Placement Trading

The Bank for International Settlements (BIS), established in 1930, is the world’s oldest international financial institution and serves as the central bank for central banks (Private placement). Over the decades, the BIS has become a pivotal regulatory and cooperative hub, guiding global monetary policy and banking standards. One niche but powerful arena under its purview…

-

The Climate Crisis Hoax Collapses: Canada’s Big Six Banks Exit the Net-Zero Banking Alliance

The global climate agenda has suffered a significant setback as Canada’s largest financial institutions, collectively known as the Big Six, have officially withdrawn from the UN-backed Net-Zero Banking Alliance (NZBA). As of January 31, 2025, not a single major Canadian bank remains part of the initiative, signaling the collapse of the so-called climate crisis narrative…