Category: Futures, Options and Commodities

-

The Copper Crunch: AI Boom and Green Energy Drive Surge in Demand

The global economy is in the midst of a seismic shift driven by technological innovation and a growing emphasis on sustainability. As artificial intelligence (AI) continues its meteoric rise and the push for green energy gains momentum, the demand for copper—a crucial component in various industries—is reaching unprecedented levels. However, with copper mines aging and…

-

Exclusive Opportunity: Premium Copper Concentrate Available for Sale

Tap into the Power of Copper: A Lucrative Investment Awaits In the dynamic world of commodity trading, securing access to high-quality materials at competitive prices is key to leveraging market opportunities and driving profitability. Today, we are thrilled to announce an exclusive opportunity for investors and traders looking to diversify their portfolios or bolster their…

-

Navigating the Essentials of Iron Ore Trading: Understanding SIOTA

The Framework of Iron Ore Trade The iron ore market operates within a complex global network, where transactions hinge on meticulously structured agreements. At the heart of these transactions is the Standard Iron Ore Trading Agreement (SIOTA), a cornerstone document designed to streamline and standardize the trading process. Let’s explore the critical components of SIOTA…

-

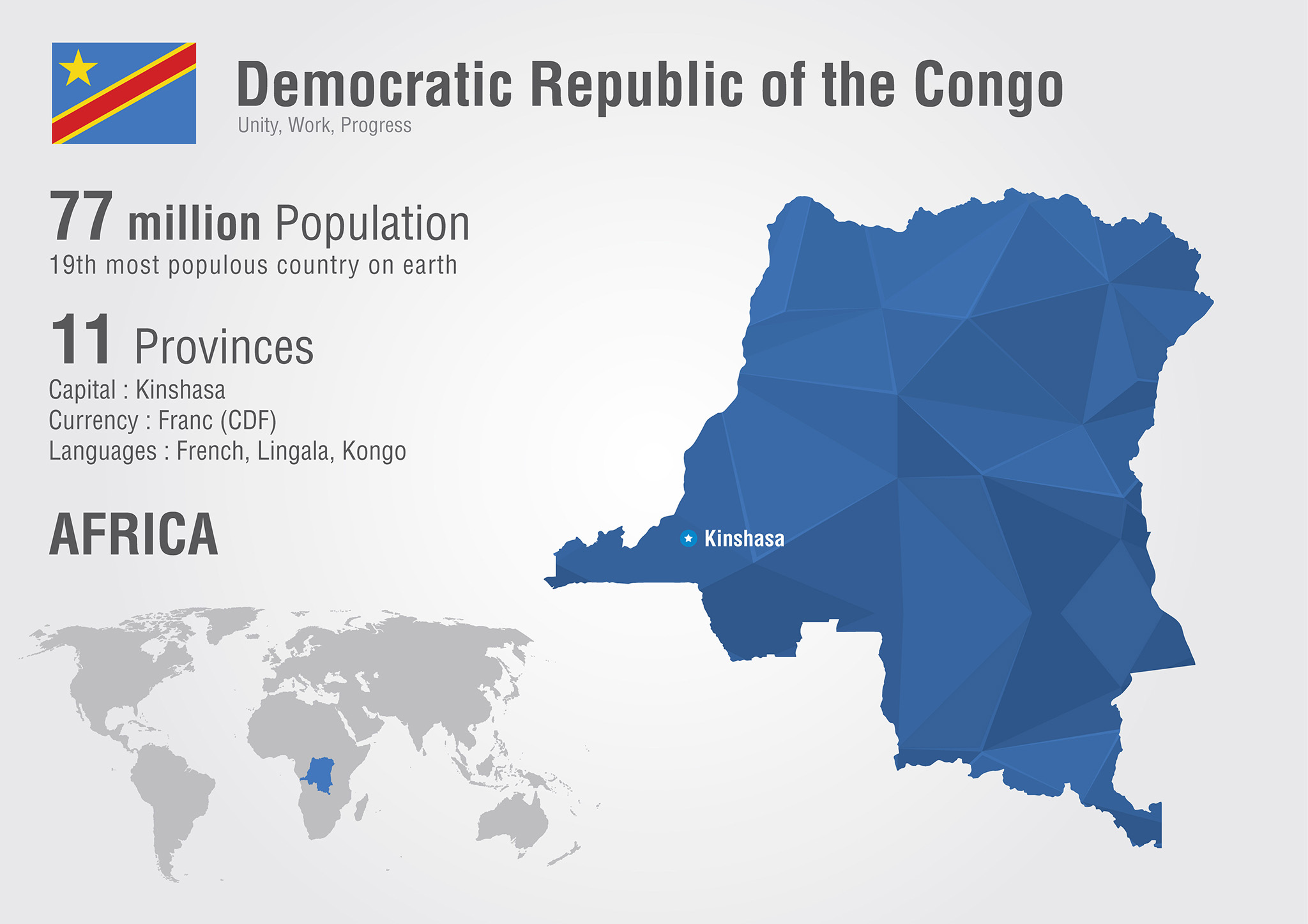

Revolutionizing the Future: The Cominca Resources Copper and Cobalt Project in DRC

Invest Offshore is proud to present a golden investment opportunity with Cominca Resources Limited, a pioneering project set to transform the copper and cobalt sectors in the Democratic Republic of the Congo (DRC). As we venture into the era of electrification and renewable energies, the demand for industrial metals, especially copper and cobalt, is skyrocketing.…

-

Unveiling Investment Opportunities in Antarctica’s Untouched Frontier

Antarctica, the southernmost continent, remains one of the most pristine places on Earth, governed by the Antarctic Treaty System that designates it as a scientific preserve. This unique status limits conventional investment opportunities, focusing on preserving its untouched environment. However, for the astute investor, there are indirect pathways to engage with this frozen frontier, leveraging…

-

Gold Wars: The US Versus Europe During The Demise Of Bretton Woods

By Jan Nieuwenhuijs of Gainvesville Coins The story on the emergence of the US dollar hegemony. After the collapse of Bretton Woods in 1971 several European central banks tried setting up a new gold pool to stabilize the price and move to a quasi gold standard. The US wanted to phase out gold from the system…

-

Simandou West Africa Iron Ore Project Update from Guinea

SYDNEY–(BUSINESS WIRE)–Rio Tinto will provide an update today at its Investor Seminar on the world class Simandou iron ore project in Guinea, which is being progressed in partnership with CIOH, a Chinalco-led consortium, Winning Consortium Simandou1 (WCS), Baowu and the Republic of Guinea. Simandou is the world’s largest untapped high-grade iron ore deposit. The Simfer joint…

-

Mexico’s Tech Hardware Boom: Attracting Investment with Incentives

In an era where technological advancements are paramount, Mexico is positioning itself as a burgeoning hub for the technology hardware industry. Recognizing the immense potential of this sector, the Mexican government is rolling out a series of incentives and initiatives designed to attract and bolster investments. Let’s explore these proactive measures that are setting Mexico…

-

The Emergence of Trading Water as a Commodity

Exploring the World of Water Trading: Opportunities, Markets, and Strategies Water trading has become an increasingly significant aspect of global commodity markets, reflecting the growing recognition of water as a scarce and valuable resource. This concept involves the buying and selling of water rights or entitlements, allowing water to be transferred from areas of surplus…