Category: Futures, Options and Commodities

-

Opium, Offshore, and Echoes of Empire: A Tale of Two Tariff Wars

In the old days, the British sent their boats full of opium to China. They wanted tea and silk and silver. China wanted none of the poison. The emperor issued edicts. Burn the opium. Close the ports. No more foreign devils ashore. It was a straight-up collision between trade and sovereignty. The British gunboats answered…

-

Affordable, Reliable, Clean Scorecard: Natural Gas Is Tops, Wind And Solar Are The Worst

Authored by James Taylor via RealClearEnergy, Policymakers on both sides of the political aisle increasingly advocate for affordable, reliable, and clean energy. This is for good reason – modern society requires energy that is affordable and available on demand. Environmental concerns are also very important. Together, affordability, reliability, and cleanliness form the three pillars of ideal…

-

Côte d’Ivoire: The Cocoa King Reigns Supreme Once Again

Côte d’Ivoire, the undisputed titan of global cocoa production, is once again proving why it wears the crown. After a turbulent 2023/2024 harvest season that sent shockwaves through European chocolate markets, all eyes are on West Africa as the next cocoa cycle promises a welcome rebound. Last year, a perfect storm of agricultural misfortune descended…

-

Key Steps to Closing an Offshore Commodity Deal: Start with CIS, POF, and LOI

When it comes to offshore commodity transactions—especially in the high-stakes world of physical gold—the deal is only as strong as its foundation. Before procedures, contracts, or logistics, the first step to closing a deal begins with verifying the buyer’s credibility and intent. The holy trinity of any serious buyer introduction in this space is the…

-

Investment Opportunities in East and West African Industrial Agriculture

Introduction East and West Africa are witnessing a surge in agribusiness investment driven by rising consumer demand, urbanization, and supportive policies. Agriculture already accounts for about one-third of Africa’s GDP and employs half of the continent’s workforce (How Africa’s AfCFTA Agreement will boost its agriculture | World Economic Forum). With the African Continental Free Trade…

-

Closing an Offshore Commodity Deal: The Golden Rule in Action

In the offshore commodity world—especially in physical gold transactions—deals succeed not because of endless documentation or drawn-out negotiations, but because of clear procedures, fast execution, and strong principal-to-principal relationships. The truth is, most deals fall apart because intermediaries delay introductions or overcomplicate what should be a straightforward process. Here are the key steps to closing…

-

Silver Shorts Spiral Out of Control as PSLV Squeeze Looms — Is a Price Explosion Imminent?

The silver market is flashing red for the big banks holding short positions — and flashing green for contrarian investors betting on a historic squeeze. As of March 31, silver short contracts tied to the Sprott Physical Silver Trust (PSLV) have reached an eye-watering 28 million, up a staggering 4 million contracts in just over…

-

The Complexities of a 42% Copper Concentrate Commodity Deal

FOB Terms and M1 Payments Against the LME Copper remains one of the most vital industrial metals in the global economy, and copper concentrate deals are at the heart of international commodities trading. But not all copper deals are created equal. When a buyer enters into an agreement to purchase copper concentrate with 42% purity…

-

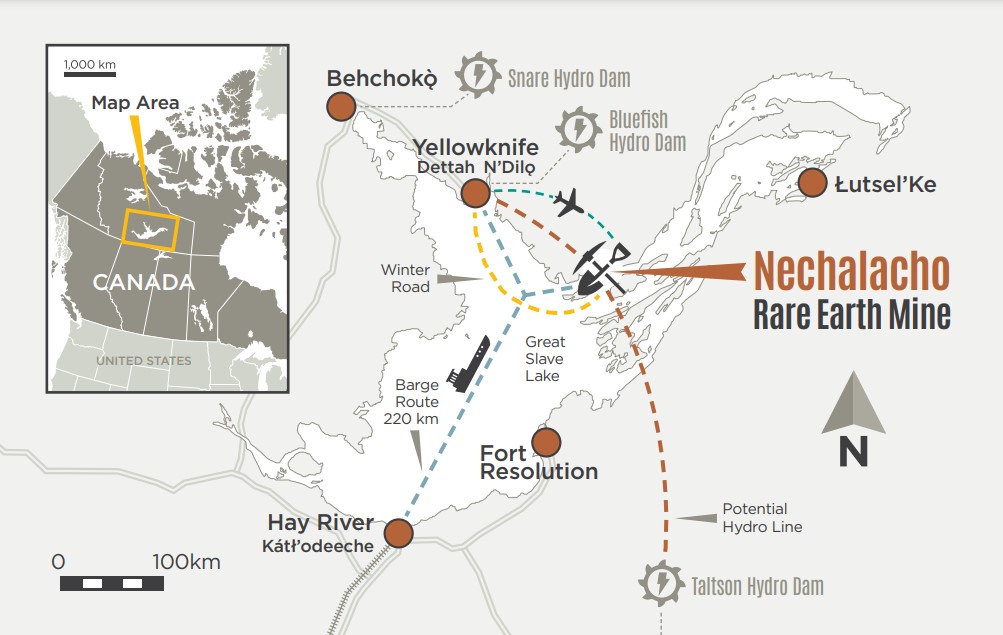

The Nechalacho Project Stands Out Among Canadian Rare Earth Resources

Operational Status Nechalacho is the first and currently only operational rare earth mine in Canada2. It began shipping concentrate in 2022, making it a pioneer in the country’s rare earth industry. Production and Scale By 2025, Nechalacho aims to produce 25,000 tonnes of concentrate annually2. This significant output positions it as a major player in…