Category: Futures, Options and Commodities

-

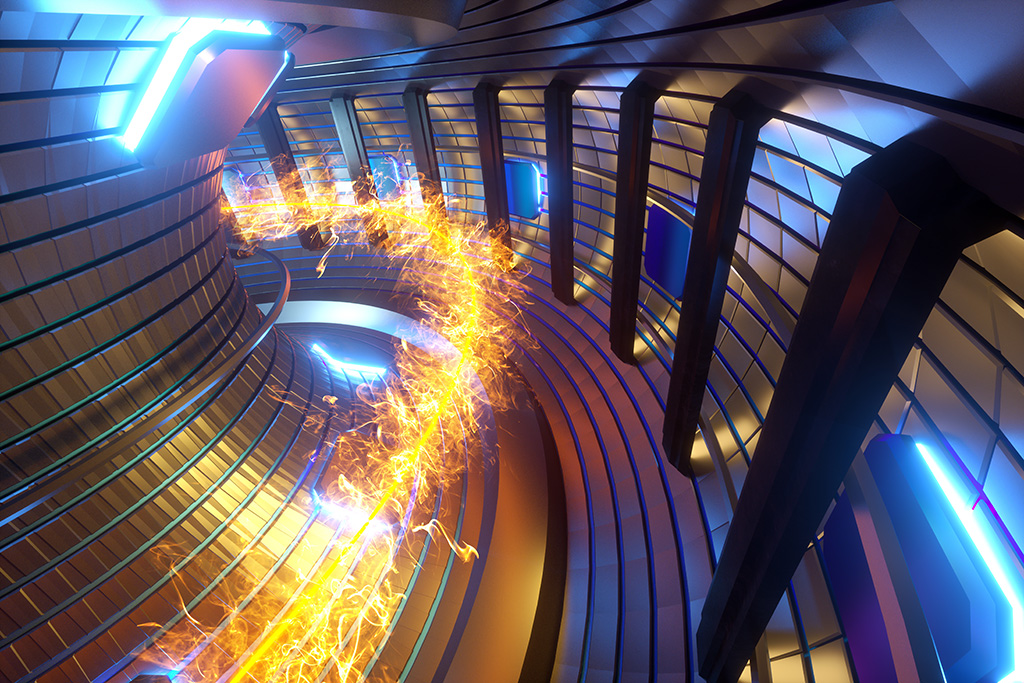

The Global Race To Unlock Nuclear Fusion

Authored by Felicity Bradstock via oilprice.com, Governments worldwide have been racing to unlock the secret to nuclear fusion energy for several decades, with the aim of producing abundant, clean energy. While several generation milestones have been achieved in recent years, accomplishing commercial-scale production continues to be extremely complex. However, with more recent successes, are we edging…

-

Caribbean Energy Week to Highlight Financing Opportunities for Suriname’s Offshore Sector

Early engagement by U.S. banks and DFIs will drive offshore development, with CEW 2026 set to connect new and sanctioned projects directly with financiers PARAMARIBO, SURINAME, March 3, 2026 /EINPresswire.com/ — As Suriname moves toward its first offshore developments in Block 58, attention is on operators such as TotalEnergies and APA Corporation. But past frontier…

-

The Rise of the “Middle Corridors”

Why Uzbekistan, Kazakhstan, and Georgia are showing up on investors’ radar For three decades, East–West trade had a “default setting”: ship by sea (cheap, slow) or move overland through the Eurasian north (fast, politically stable—until it wasn’t). Since Russia’s full-scale invasion of Ukraine, companies and governments have been forced to re-price geopolitical risk in real…

-

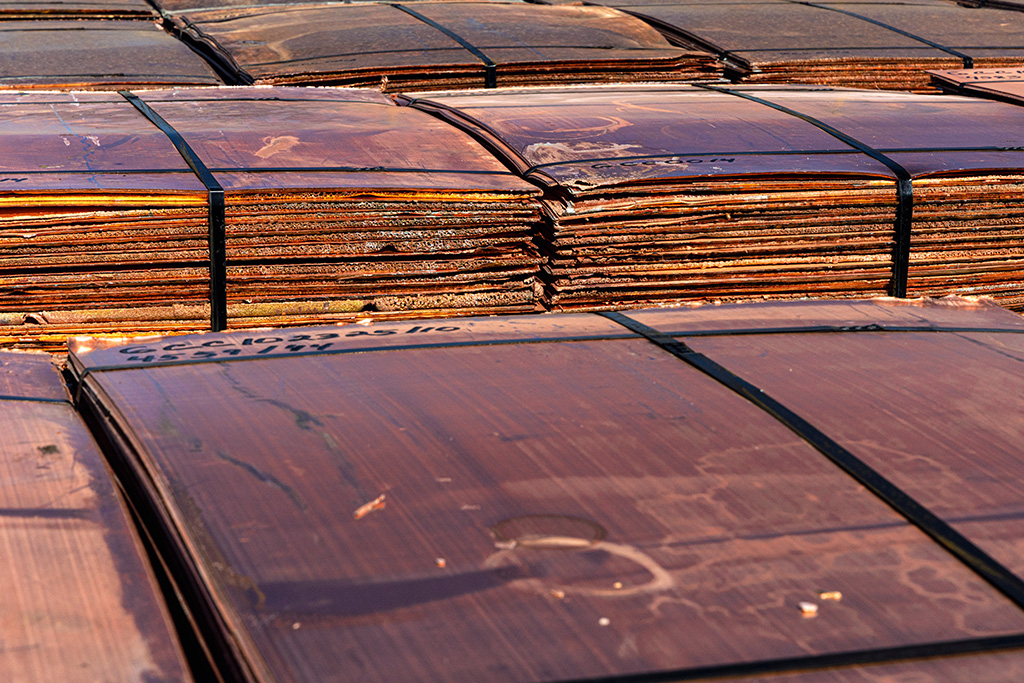

Why North American Buyers Prefer LC at Sight for African Metals

And how to verify legitimate copper cathode supply from Africa—without getting played. If you’ve spent any time around cross-border metals trading, you’ve heard the same refrain from buyers in United States and Canada: “We’ll do it on an irrevocable, confirmed LC at sight—or we’re not doing it.” To sellers across Africa, that can feel rigid.…

-

Young Day-Trader Influencers Are Rewiring Retail Finance Culture

Scroll any finance feed today and you’ll see it: a 19-year-old explaining “market structure” in 30 seconds, a flashy P&L screenshot, a luxury-lifestyle montage set to a chart breakout, then a link to a Discord, course, or “signals” room. This isn’t a passing internet phase. Young day-trader influencers—often called “finfluencers”—have become a major on-ramp into…

-

Dubai Gold & Commodities: How Real Money Moves in 2026

Forget the screens. Forget the ETFs. Forget the paper promises. When real capital wants real assets—gold you can weigh, assay, vault, and move—it goes to Dubai. Dubai isn’t a “market.” It’s a clearing house for hard money. A place where bullion, doré, copper, diamonds, and sugar move quietly between sovereigns, refiners, and institutions while retail…

-

China’s Monetary Flood: Fake Paper, Real Assets

China is quietly executing the largest monetary expansion in its modern history—outside of the COVID emergency years—and the numbers are staggering. China’s M2 money supply has gone vertical, now sitting north of USD $48 trillion in equivalent terms. To put that into perspective, this is more than double the total U.S. M2 money supply. This…

-

How to Buy a Mine in British Columbia (Without Getting Buried Alive)

Everybody says they want hard assets—until they realize hard assets require hard decisions. Buying a mine in British Columbia isn’t about romance, gold pans, or rugged selfies in Carhartt jackets. It’s about control, cash flow, permits, and optionality. And if you don’t understand the ladder of mining assets, you’ll overpay for dirt—or worse—buy a liability…

-

Canada, Silver, and the Reality No One Else on Earth Can Match

The truth has a way of surfacing when markets stop being polite. And right now, silver is no longer polite. Everyone’s staring at gold like it’s the only adult in the room. Safe haven. Store of value. Central banks cuddling it like a security blanket. Fine. Gold has its place. But silver? Silver is where…