Category: ETF, Hedge & Mutual Funds

-

📝 The Rise of Bitcoin & the ETF Boom: An Offshore Investor’s Perspective

Bitcoin is rewriting the history books yet again. After breaking its previous record in May, BTC recently surged past $118,000, and even neared $119,000–$120,000, driven by massive inflows into spot Bitcoin ETFs (MarketWatch). 🔍 Institutional Capital Floods In Analyse this: such consistent, large-scale investment from institutional players (with BlackRock, Fidelity, Ark leading the charge) signifies that…

-

Smart Robots Market to Quadruple by 2034: A New Frontier for Offshore Investors

The global Smart Robots Market is poised for explosive growth, surging from a valuation of USD 33.83 billion in 2024 to an estimated USD 135.83 billion by 2034, representing a compound annual growth rate (CAGR) of 26.5%. This transformation, outlined in a recent report by The Research Insights, signals one of the most compelling long-term…

-

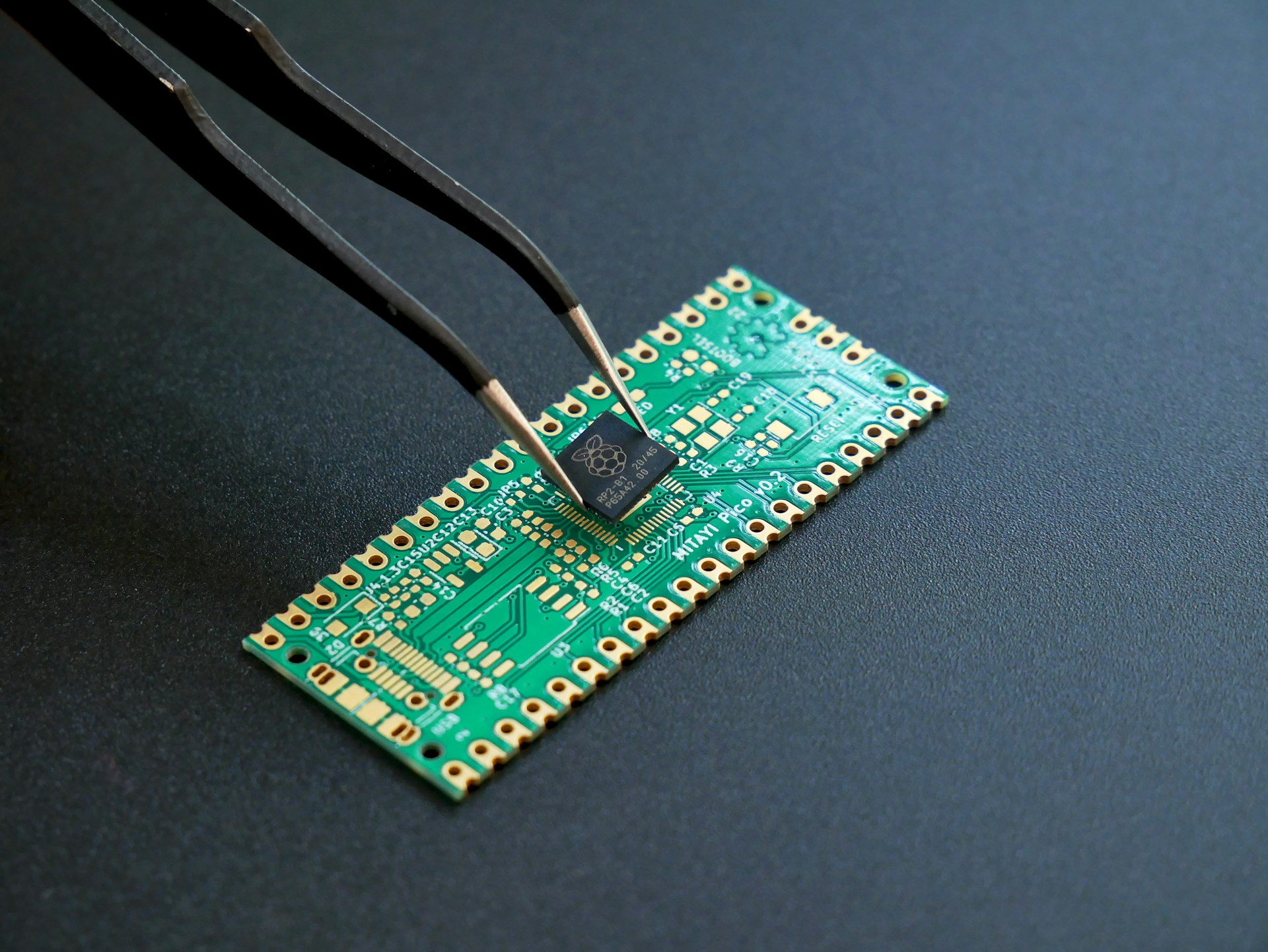

The Best ETF, Hedge, and Mutual Funds for Investing in the Semiconductor Surge

The global race for artificial intelligence (AI) dominance has catapulted semiconductor stocks into the investment spotlight. As NVIDIA, AMD, TSMC, Broadcom, and Marvell Technology dominate headlines and portfolios, savvy investors are looking for efficient ways to gain exposure — not just through individual stock picking, but through carefully chosen ETFs, hedge funds, and mutual funds.…

-

Franklin Templeton Files for XRP ETF: A Game-Changer in Crypto Investing?

Franklin Templeton, one of the world’s leading asset managers with a staggering $1.4 trillion in assets under management, has taken a bold step into the cryptocurrency market. The firm recently filed an S-1 registration form with the U.S. Securities and Exchange Commission (SEC) to launch an exchange-traded fund (ETF) based on XRP, the digital asset…

-

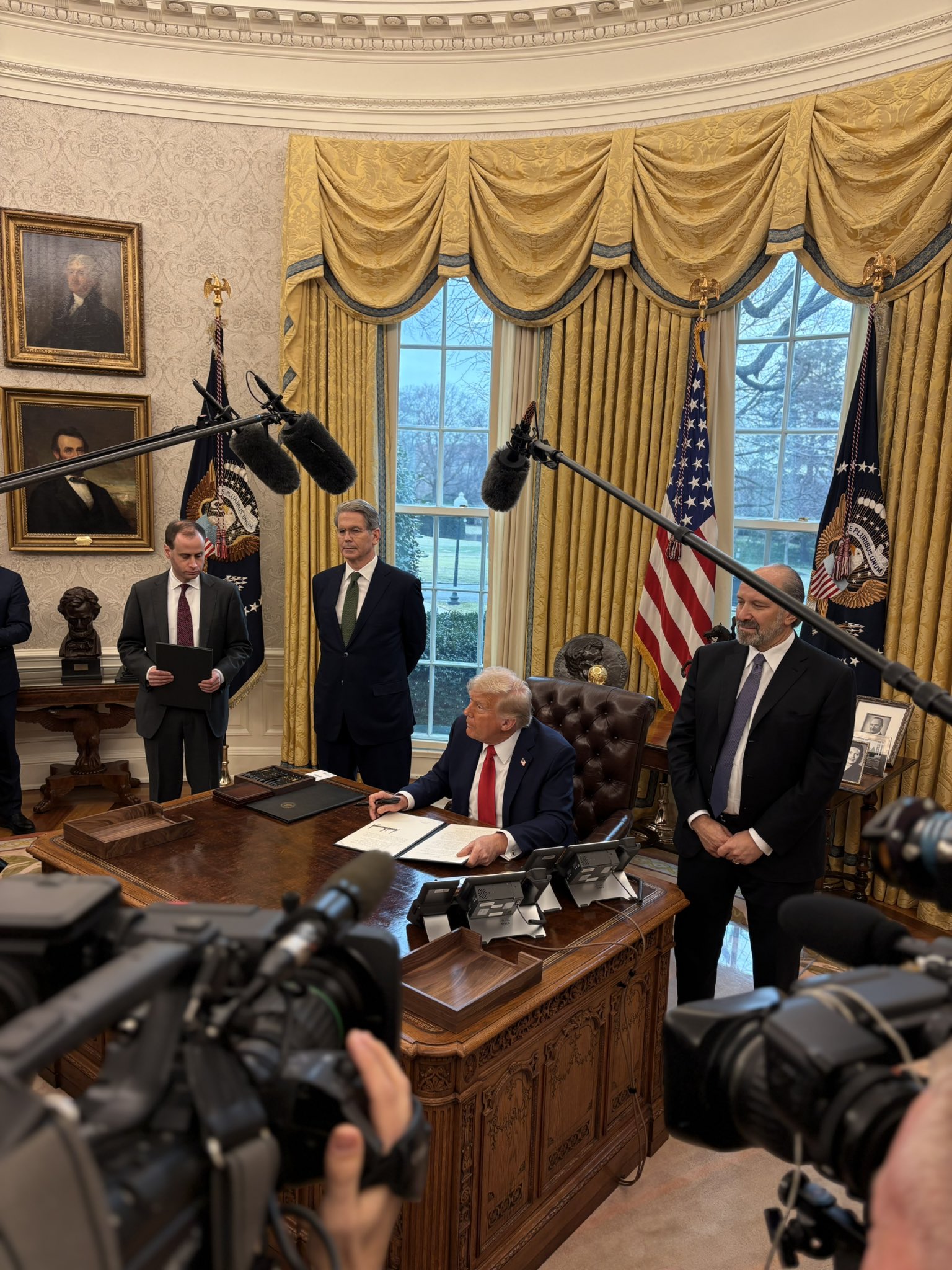

Trump Establishes U.S. Sovereign Wealth Fund to Monetize National Assets

On February 3, 2025, President Donald Trump signed an executive order establishing the first-ever U.S. Sovereign Wealth Fund, a strategic move aimed at monetizing the nation’s assets to generate value for American citizens. This initiative, led by Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick, seeks to transform underutilized federal assets into profitable investments…

-

BlackRock’s iShares Bitcoin Trust: A Record-Breaking ETF Amid Rapid Financial Evolution

The world of cryptocurrency and institutional finance has witnessed a groundbreaking moment with BlackRock’s iShares Bitcoin Trust (IBIT). Launched just 11 months ago, this exchange-traded fund (ETF) has amassed over $50 billion in assets, earning the title of the fastest-growing ETF in history. This achievement highlights the accelerating acceptance of Bitcoin in institutional portfolios, signaling…

-

Hedge Funds Reap $1.2 Billion by Shorting Renewable Energy Stocks After Trump Win

In a notable pivot, hedge funds have recently reaped profits exceeding $1.2 billion by shorting renewable energy stocks following Donald Trump’s election victory. By betting against the shares of around 20 companies in the renewable energy sector, these funds capitalized on anticipated policy shifts away from the green initiatives that flourished under the previous administration.…

-

Grayscale Launches First U.S. XRP Trust, Paving the Way for Potential ETF

In a move that could reshape the landscape of crypto investment, Grayscale Investments has launched the first U.S.-based XRP trust, marking a significant step toward expanding its offerings in the digital asset space. As the demand for XRP increases, especially following Ripple’s partial legal victory over the SEC, Grayscale’s XRP Trust could be the precursor…

-

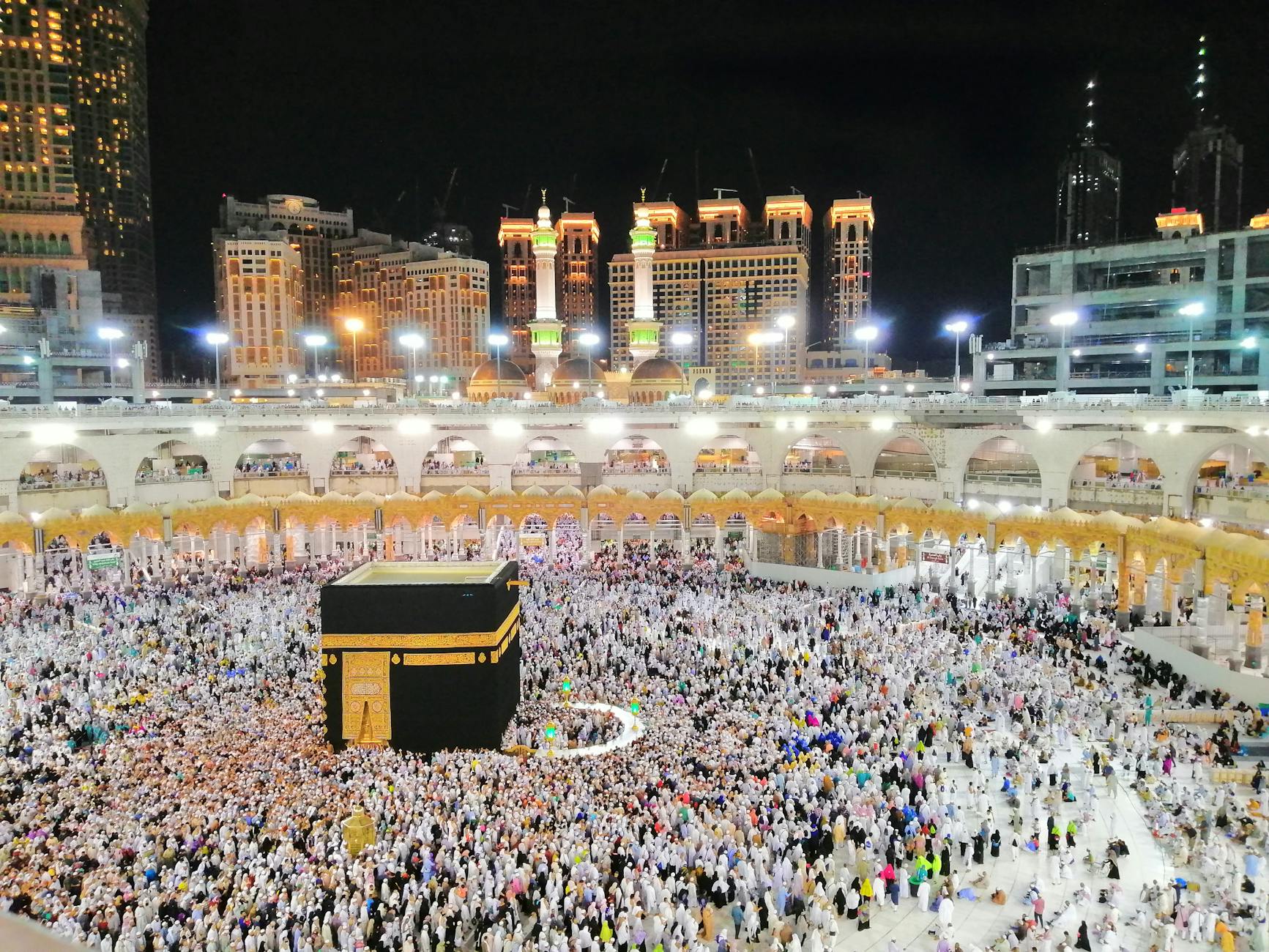

Saudi ETFs: A Smash Hit Among Chinese Onshore Investors

In an evolving global financial landscape, Chinese onshore investors are increasingly turning their attention to Saudi Exchange Traded Funds (ETFs), highlighting a significant shift in investment strategies and international financial alliances. The Rise of Saudi ETFs Saudi ETFs have gained substantial popularity among Chinese investors, driven by several key factors. First, Saudi Arabia’s economic reforms…