Category: ETF, Hedge & Mutual Funds

-

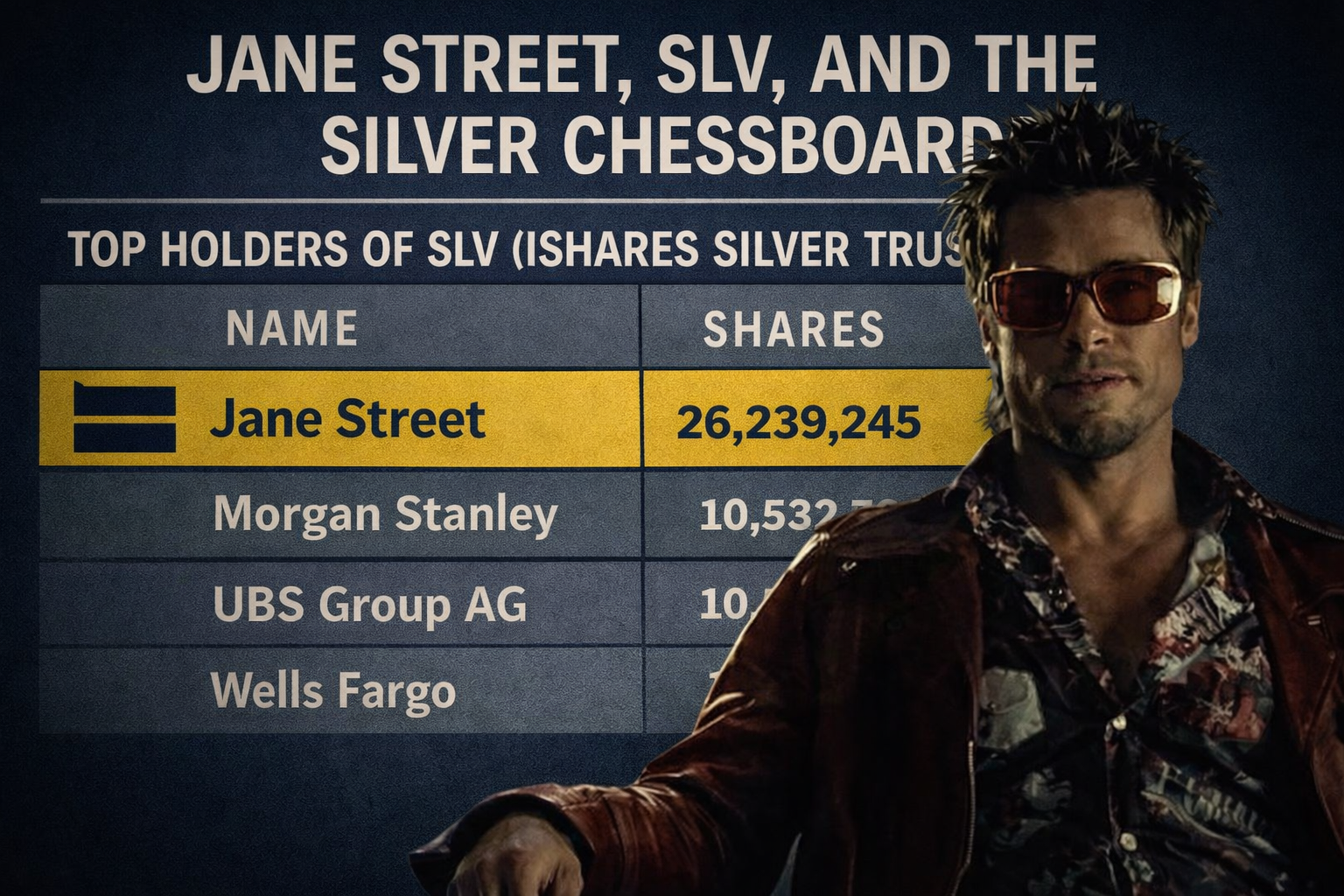

Jane Street, SLV, and the Silver Chessboard

I love silver.I’ve loved silver since 2009—when nobody cared, when it was cheap, hated, and misunderstood. But loving silver and trusting the silver market are two very different things. On February 25, 2026, @zerohedge dropped a little grenade on X: “We have been huge silver bulls since 2009, but be very careful here: lots of…

-

Wall Street has Captured Bitcoin and Turned into a Derivative

By Gordon Gekko, for Invest Offshore You still think Bitcoin trades like a clean, supply-and-demand asset? Then listen closely—because that market no longer exists. What you’re watching isn’t “weak hands.” It isn’t sentiment. It isn’t retail panic-selling. It’s a structural takeover—the kind that happens when Wall Street gets its claws into something scarce, something pure……

-

Shorting the Wind: Why Inverse Plays on Wind ETFs Are Back on the Table

At the World Economic Forum 2026 in Davos, Donald Trump delivered a blunt message that sent a chill through the renewables narrative. Calling green energy policies the “greatest hoax in history” and deriding the Green New Deal as a “Green New Scam,” Trump singled out wind energy as emblematic of policy-driven misallocation of capital. Whether…

-

🚀 Why the Recent XRP ETF Surge Is a Big Deal

The past few weeks have seen a dramatic renaissance for XRP — not because of some sudden breakthrough in payments adoption, but thanks to an avalanche of institutional money flowing into newly launched regulated exchange-traded funds (ETFs). For anyone following crypto or digital-asset investing, this marks a major turning point. 📈 What’s Happening With XRP…

-

The Bull Market in Gold: GLD and GLDX Indicate More Upside Ahead

In the world of gold investing, few indicators are as closely watched as GLD — the SPDR Gold Shares ETF. As the largest and most liquid gold-backed exchange-traded fund in existence, GLD acts as a real-time sentiment barometer for global investors. When capital flows into GLD, it typically reflects growing bullish conviction across the gold…

-

Physical Silver vs. Silver ETFs: Cost Structures and Long-Term Value

In 2025, silver remains one of the most compelling assets for investors seeking inflation protection and portfolio diversification. Yet, how you invest in silver — physically or through exchange-traded funds (ETFs) — can dramatically influence returns. The cost structures between silver ETFs and physical bullion differ substantially, impacting both short-term efficiency and long-term sovereignty. Silver…

-

First U.S. Spot XRP ETF Debuts with Explosive Volumes: A Pivotal Moment for Ripple’s Asset Class

On September 18, 2025, the U.S. financial markets witnessed a historic milestone with the debut of the first spot XRP ETF. The launch shattered expectations, registering record-breaking trading volumes and signaling strong institutional and retail demand for regulated exposure to Ripple’s native cryptocurrency. This watershed moment confirms XRP’s evolution from a cross-border payment token to…

-

All the Ways to Invest in Copper: ETFs, Miners, Crypto, and Stocks

Copper has become one of the most compelling investment stories of our time. Often called “the new oil”, this industrial metal powers the backbone of electrification — from EV batteries and renewable energy to data centers and smart grids. With demand expected to double by 2035, investors are asking: what’s the best way to gain…

-

Riding Democratic Insider Trades: Unusual Whales’ NANC ETF

In an increasingly polarized investment landscape, a novel ETF has captured investors’ attention—not for its thematic focus on tech megacaps, but because it directly follows the stock and option trades of Democratic lawmakers and their spouses. Launched in February 2023, the Unusual Whales Subversive Democratic Trading ETF (ticker NANC) allows investors to piggy‑back on insider-chic political portfolios—most…