Category: Asset Protection

-

The “CRS Survival Guide” (2026 Edition)

A plain-English explanation of automated tax information exchange — and what “legal privacy” actually means today There was a time when “offshore” was shorthand for secrecy. In 2026, it mostly means cross-border compliance. The Common Reporting Standard (CRS) is the plumbing behind that shift: a global system that tells banks what to collect, tells tax…

-

Bitcoin Betrayal: A Potential Financial Scam of Epic Proportions?

Disclaimer: The following article examines claims circulating online and explores hypothetical risk scenarios. These allegations are unproven and highly contested. Invest Offshore does not endorse these claims as fact. However, because of their potential implications for market confidence, they warrant very careful analysis. Allegations of Hidden Control Over Bitcoin and What It Could Mean for…

-

The Mensa Leak: The Quiet Formula for Financial Freedom

At Invest Offshore, we often encounter capital strategies that never appear in glossy brochures or social media feeds. They circulate discreetly among family offices, sovereign advisers, and analytical minds who see money as a tool, not a destination. Recently, one such framework surfaced—attributed to a Mensa group member and shared privately before quietly leaking into…

-

Asset Protection: Even Google’s Founders Have Had Enough of California—and Are Saying Adiós

California was once the unquestioned capital of innovation, capital formation, and entrepreneurial freedom. Today, it is becoming a case study in what happens when success is treated as a public utility. In the days leading up to Christmas, Google founders Larry Page and Sergey Brin quietly began unwinding portions of their California-based financial empires, according…

-

The Grand Conspiracy

2025: The Year the Counter-Revolution Went Mainstream In the language of history, there are moments when the official narrative collapses under its own weight. 2025 will be remembered as one of those moments—a year when a growing share of the global public concluded that the real conspiracy was not dissent itself, but the coordinated systems…

-

The Modern Offshore Investor: How to Structure International Holdings Across Banks, Trusts, and Corporate Entities

By Steven James – OCBF Consulting LLC There has never been a more complicated moment in time to be a global investor. Markets are volatile, governments are unpredictable, and the list of jurisdictions promising “stability” seems to fall every year. Yet, surprisingly, this is also the best time in history to build an internationally structured…

-

The Great Financial War Has Begun: A Message from Juan O Savin

They say when the tide goes out, you find out who’s swimming naked. Well guess what? The tide isn’t just going out—it’s being pulled by a financial tsunami, and the sharks are already feeding. I got a message last night—urgent—from Juan O Savin. The kind of guy who doesn’t waste words. When he calls, I…

-

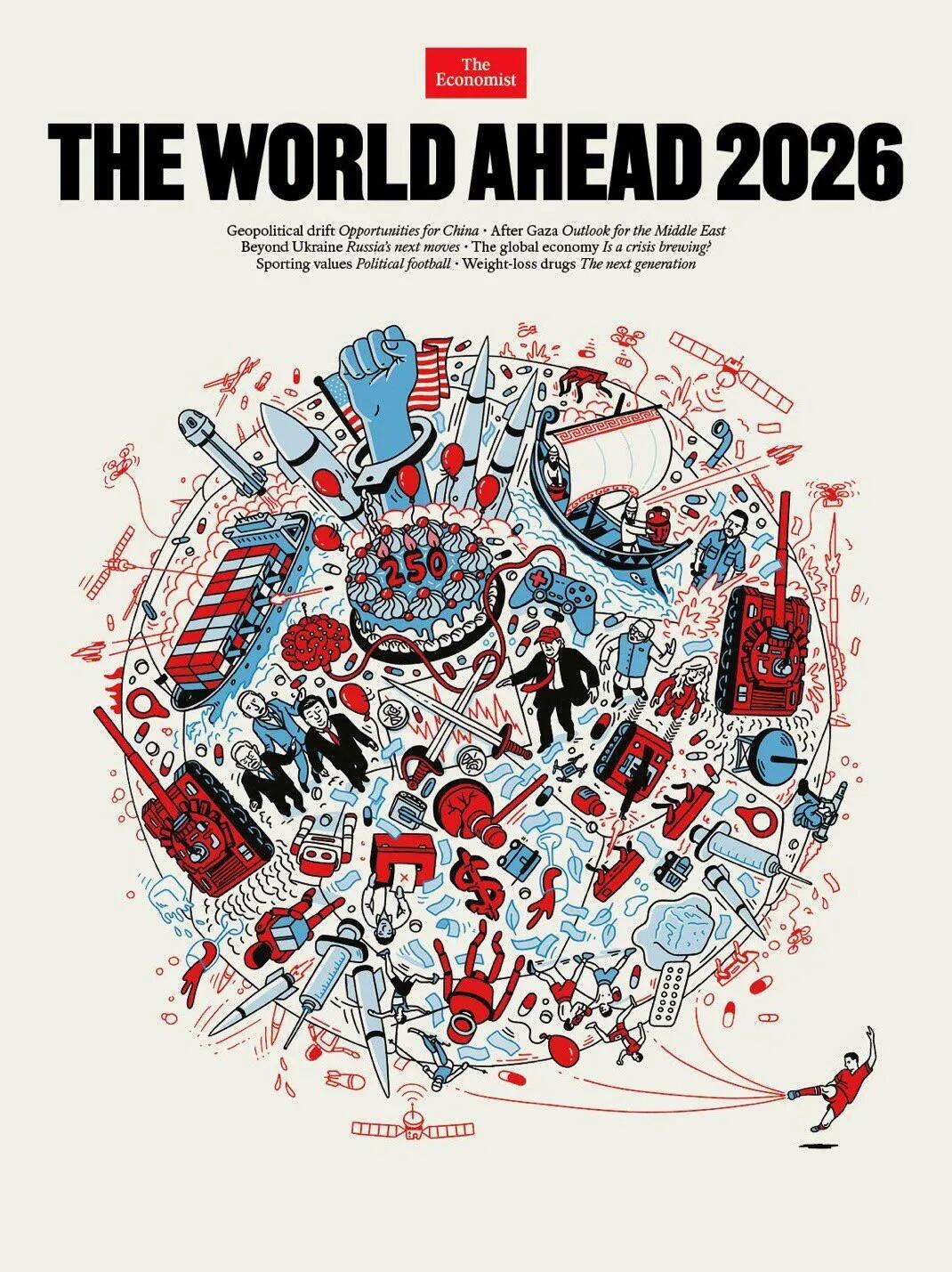

Super Creepy ‘The World Ahead 2026’ Economist Magazine Cover Signals War, Pestilence, & Financial Collapse Next Year

Authored by Michael Snyder via The End of The American Dream blog, There is one magazine that represents the interests of the global elite more than any other. It is known as “The Economist”, and each year it puts out an issue that is dedicated to what is coming in the year ahead. As we have…