Author: Aaron

-

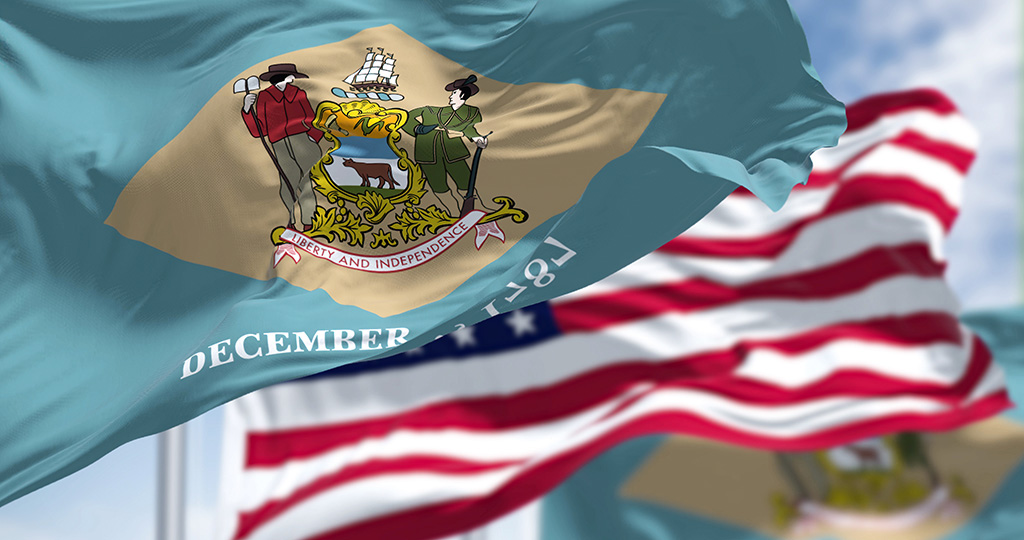

Delaware: America’s Oldest Corporate Safe Harbor

When Larry Page, co-founder of Google and a principal force behind Alphabet, quietly shifts his corporate base to Delaware, it sends a clear signal. For founders, boards, and global investors alike, Delaware remains the safest jurisdiction in America to run a large enterprise with peace of mind. Delaware’s appeal has nothing to do with size.…

-

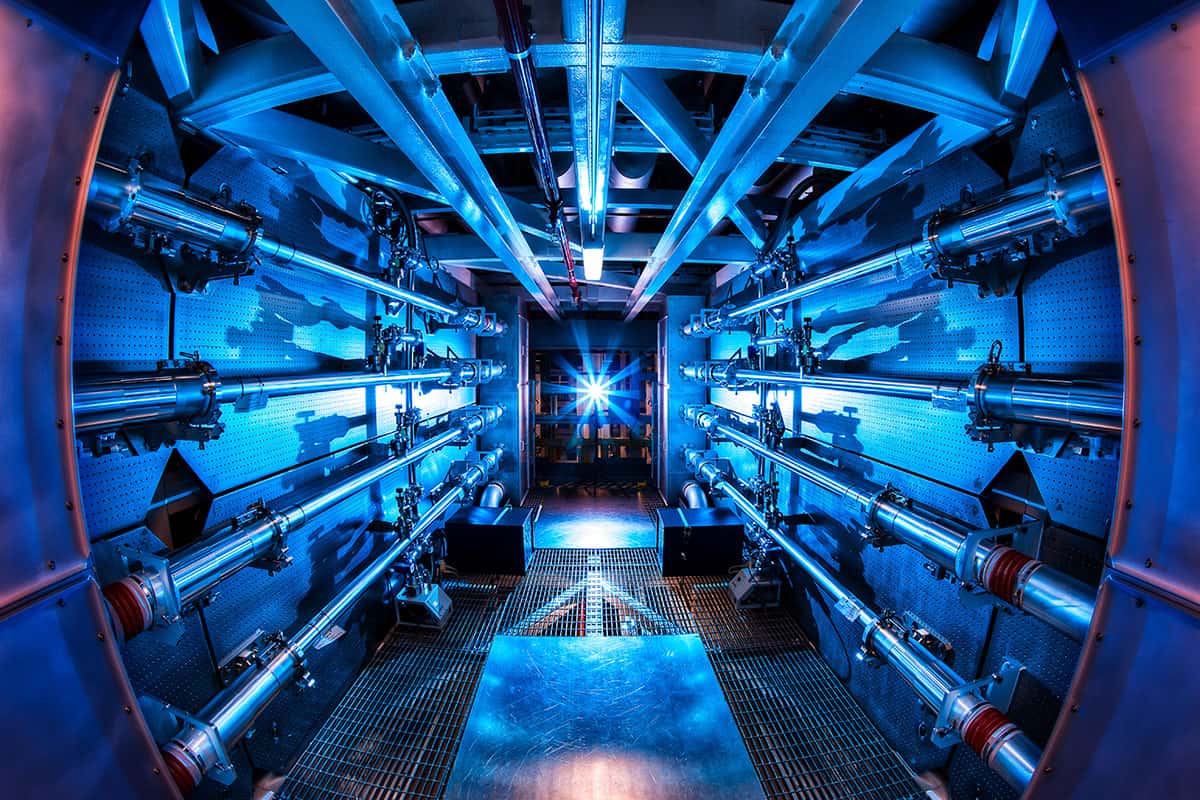

Invest Offshore Recommends Zero Hedge’s “Where The Department of Energy Is Investing”

Invest Offshore is recommending a timely and insightful analysis published by Zero Hedge, submitted by Tight Spreads, titled “Where The Department of Energy Is Investing.” The article cuts through the noise to explain why fusion energy is accelerating a quiet but massive U.S. push to securitize domestic rare earth and advanced-materials supply chains—and which companies…

-

From a Family Garage to Global Blockchain Banking: The Story of Bank Frick

In an era when most European private banks trace their roots to centuries-old aristocratic lineages, Bank Frick stands out for a very different reason: its modern origin story and its early embrace of financial innovation. A Garage Start-Up in the Alps (1998) The bank was founded in 1998 by Liechtenstein fiduciary Kuno Frick Sr. (1938–2017)…

-

The New Sultan of Persia? Imagining an Iranian Re-Boot Under the Qajar Heir

For decades, Iran has been frozen between an ancient civilizational memory and a modern political reality that has delivered neither peace nor prosperity to its people. Yet history has a way of resurfacing—sometimes quietly, sometimes symbolically—before it becomes catalytic. A growing body of discussion among historians, royal-house enthusiasts, and diaspora commentators is now revisiting a…

-

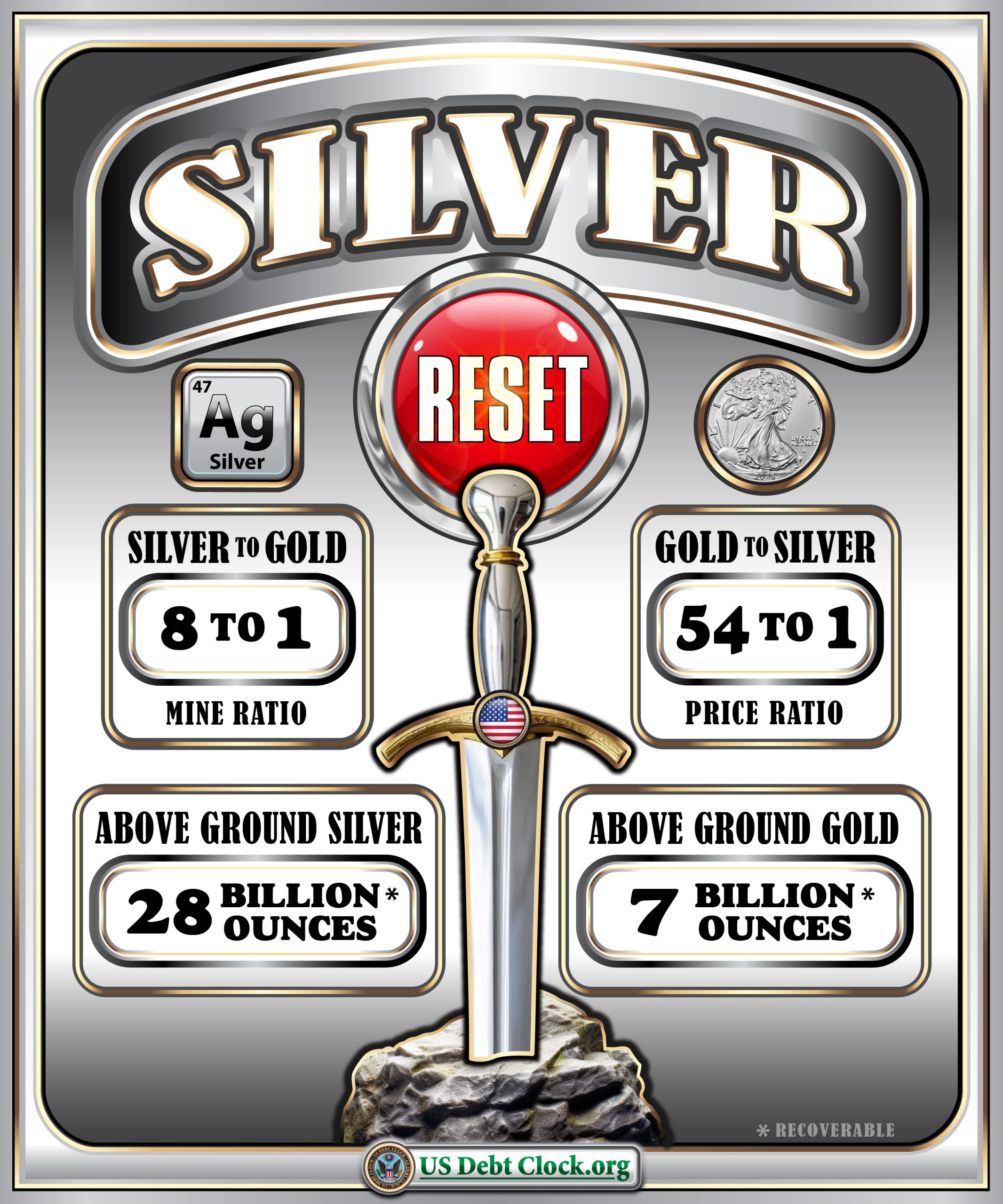

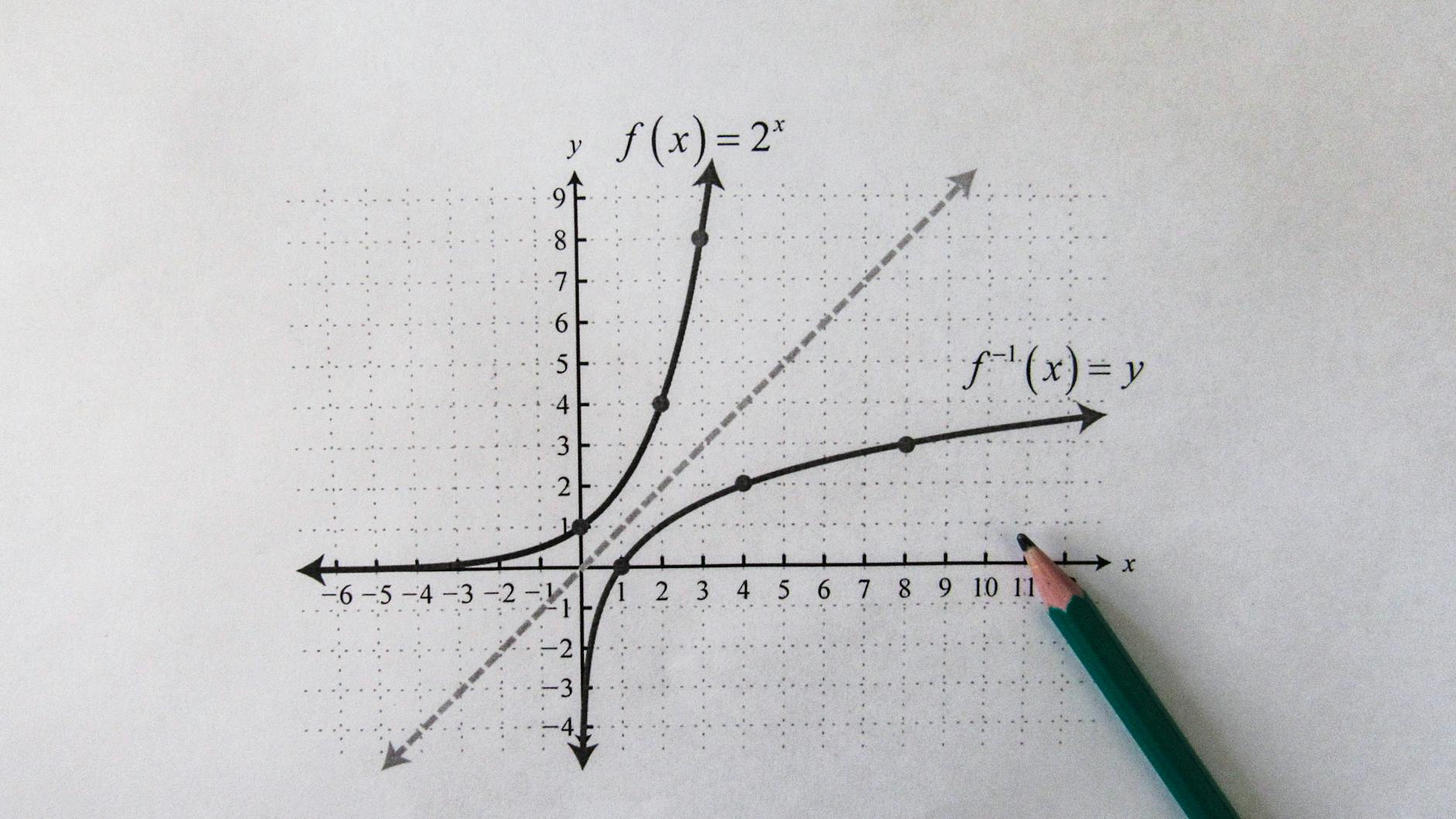

The Mensa Leak: The Quiet Formula for Financial Freedom

At Invest Offshore, we often encounter capital strategies that never appear in glossy brochures or social media feeds. They circulate discreetly among family offices, sovereign advisers, and analytical minds who see money as a tool, not a destination. Recently, one such framework surfaced—attributed to a Mensa group member and shared privately before quietly leaking into…

-

After the Flames: How the Palisades Fire Reshaped LA County Real Estate

The January 7, 2025 Palisades Fire — ignited in the Santa Monica Mountains and coupled with the Eaton Fire — was one of the most destructive wildfire events in Los Angeles County history. Together, these blazes burned more than 37,000 acres and destroyed over 16,000 structures, including more than 11,000 homes. The human toll was…