In my estimation, Central Bankers around the world have an acute fear of deflation. Their prescription has been (and continues to be) hefty doses of easy money. A plethora of British Pounds, and abundance of Euros, a deluge of US Dollars, a surplus of Swiss Francs. This is an ongoing and concerted strategy to avoid deflation at all costs. From where I sit, the FOMC, the BoJ, BoE, and ECB appear to be employing a Martingale System, and like countless other junkies/enablers they are lying about their ability to rein in their habit.

Central Bankers will stay the course because after nearly 5 years of heavy use – the markets are addicted. To be fair, the MIT educated PhDs delivering the drug have been threatening to “taper” It’s like Librium for the alcoholic because going Cold Turkey causes seizures and can be terminal. That is far too great a risk.

At first the Quantitative Easing efforts seemed appropriate and relatively benign. The Global Economy was in the throes of a deep contraction after credit markets froze in 2008 forcing a number of firms into bankruptcy (not nearly enough) and others into arranged marriages. Now the prescription may be doing more harm than good. Malinvestment happens when incentives and expectations become very skewed. Are we near that point?

See also Bill Gross’ missive today: http://www.pimco.com/EN/Insights/Pages/Wounded-Heart.aspx

It’s worth noting that the ECB has actually reduced the size of their balance sheet over the past year. However, their austerity has been more than counter balanced by the Bank of Japan, Bank of England, Federal Reserve and Swiss National Bank.

On May 22nd (when a number of Global Equity markets peaked) the FOMC balance sheet hit a new record of $3.4 trillion.  Bank of England:

Bank of England:  Swiss National Bank:

Swiss National Bank: I won’t even bother with the Bank of Japan – they are the worst offenders and they have been fighting deflation since I was in grade school (and I’m 36). You get the idea.

I won’t even bother with the Bank of Japan – they are the worst offenders and they have been fighting deflation since I was in grade school (and I’m 36). You get the idea.

This year, we’ve seen a resurgence in the deflation trade (US dollar higher, commodities, precious metals in particular lower). Check out Hedge Fund positioning in the Dollar Index:

Hedge fund/speculative timing with respect to the Dollar Index has been poor over the past 5 years. I doubt that this time is any different.

Now let’s look at Silver through the lens of Hedge Funds/speculative types.  Spec shorts are at/near record highs and longs are pretty much at the lowest levels in Silver since 2001. Notice the tendency for specs to be very long around tops and vice versa? Me too.

Spec shorts are at/near record highs and longs are pretty much at the lowest levels in Silver since 2001. Notice the tendency for specs to be very long around tops and vice versa? Me too.  Over the same time frame, Silver just experienced it’s second 50+% correction. Silver is not a market for the faint of heart. Moves like that have a way of shaking out even the biggest bulls.

Over the same time frame, Silver just experienced it’s second 50+% correction. Silver is not a market for the faint of heart. Moves like that have a way of shaking out even the biggest bulls.  That brings me to the growing thunder of herd mentality.

That brings me to the growing thunder of herd mentality. And here is a look at Global Asset RSI levels (weekly): Notice the Nikkei no longer tops the overbought list and the Turkish ISE has fallen considerably as well.

And here is a look at Global Asset RSI levels (weekly): Notice the Nikkei no longer tops the overbought list and the Turkish ISE has fallen considerably as well. Gold and Silver combined COT report (long term)

Gold and Silver combined COT report (long term) Year over Year Gold performance – are we close to a pivot?

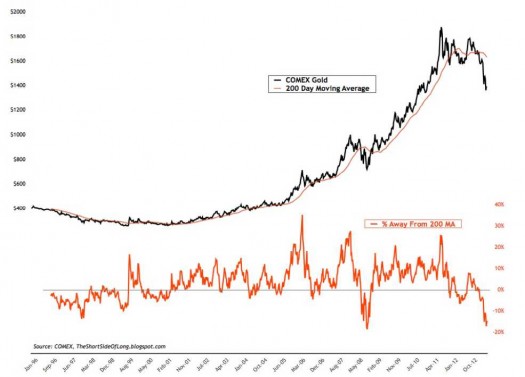

Year over Year Gold performance – are we close to a pivot? Finally, Gold v. it’s 200 day Moving average. Stretched historically:

Finally, Gold v. it’s 200 day Moving average. Stretched historically: In synopsis, the easing continues (and in my opinion WILL continue despite the taper threats). Ultimately it may not matter because there has been about 16 trillion in USD equivalents created over the past 5 years. Most of that has not worked it’s way into the system because of perverse incentives.

In synopsis, the easing continues (and in my opinion WILL continue despite the taper threats). Ultimately it may not matter because there has been about 16 trillion in USD equivalents created over the past 5 years. Most of that has not worked it’s way into the system because of perverse incentives.

The contrarian in me says that at some point before long, we’ll see the velocity of money pick up. It may be a rudimentary analysis, but I know my wife and I get at least 3 credit card solicitations a week in the mail. Lending standards are becoming more lax. Banks will look for new ways to make their cheap money make more money. I’m bullish of Precious Metals in general chair it looks like Gold double bottomed between 1350 and 1320. Silver has found support around $22 with the exception of the Sunday night freak out from a couple weeks back. I favor Silver because the GC v. SI ratio is at a level that has been friendly to Silver’s outperformance, but if you share my overall thesis that it’s highly unlikely Central Banks will be able to remove the liquidity punchbowl at just the right time then looking for creative ways to get long delta exposure in Gold or Silver may make sense.

I’m bullish of Precious Metals in general chair it looks like Gold double bottomed between 1350 and 1320. Silver has found support around $22 with the exception of the Sunday night freak out from a couple weeks back. I favor Silver because the GC v. SI ratio is at a level that has been friendly to Silver’s outperformance, but if you share my overall thesis that it’s highly unlikely Central Banks will be able to remove the liquidity punchbowl at just the right time then looking for creative ways to get long delta exposure in Gold or Silver may make sense.

Medium term, I would target a move back toward 55 on the GC v. SI ratio from the current 62.

Call Kevin Davitt @ 312.870.1520 to discuss risk v. reward scenarios that may be appropriate.

Risk Disclaimer:This information is not to be construed as an offer to sell or a solicitation or an offer to buy the commodities and/ or financial products herein named. The factual information of this report has been obtained from sources believed to be reliable, but is not necessarily all-inclusive and is not guaranteed to be accurate. You should fully understand the risks associated with trading futures, options and retail off-exchange foreign currency transactions (“Forex”) before making any trades. Trading futures, options, and Forex involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more than your initial investment. Opinions, market data, and recommendations are subject to change without notice. Past performance is not necessarily indicative of future results. This report contains research as defined in applicable CFTC regulations. Both RCM Asset Management and the research analyst may have positions in the financial products discussed.

Leave a Reply